Briefing / The role of the NHS chief finance officer

Draft statement

NHS chief finance officers (CFOs) are at the heart of organisations’ management structures. With huge pressure on public finances, the CFO’s role is more challenging and demanding than ever.

The statement provides an analysis of what the role involves, covering the following key CFO attributes: values; qualifications, experience and practical skills; personal characteristics; and key roles.

Although it is written from the perspective of the NHS in England the principles set out apply equally to CFOs working in Northern Ireland, Scotland and Wales.

This draft statement supersedes the one that the HFMA issued in 2017, including a new section on the role of the CFO in partnership working, and takes account of other relevant guidance issued since then. The draft statement will be finalised at the end July 2024 and the HFMA welcomes any comments for consideration to be sent to [email protected].

In particular we welcome feedback on the following questions:

- Do you agree with the four essential key attributes: values; qualifications, experience and practical skills; personal characteristics; and key roles?

- Do you have any comments on the six key roles outlined in the draft statement?

- In your experience, does the new role 6: working with partners, accurately describe the role of the CFO in system working?

- Are there any further example activities to be included in appendix 2?

Why we are issuing this statement

NHS chief finance officers (CFOs) – also called finance directors or directors of finance – are at the heart of organisations’ management structures. CFOs play a key role in efficiently delivering safe, effective and economically sustainable services providing strategic focus, corporate management, decision-making and leadership. They also have responsibility for setting an organisation’s overall ‘financial tone’ and for establishing a culture that encourages partnership working, innovation, the achievement of quality and value for money while ensuring that public money is used wisely, safely and well.

CFOs can have a real impact on patient care by ensuring that patients’ interests are at the centre of decision taking and developing innovative financial arrangements to support healthcare improvements, enabling swift and appropriate treatments that are right first time so that unnecessary admissions and re-admissions are avoided.

As well as being able to demonstrate strong leadership skills from a financial and corporate perspective, existing and potential CFOs must know their businesses thoroughly and understand the wider environment within which they operate. They must also be able to think strategically, communicate effectively with a wide variety of stakeholders and be prepared to work collaboratively across boundaries with a sound appreciation of the collective challenges and priorities that face them and their local health systems.

With huge pressure on public finances, the CFO’s role is currently even more challenging and demanding. To be successful he or she must possess excellent technical skills, the strength of character to stand by decisions and cope with heightened levels of regulator and media scrutiny and public interest. This requires an ability to remain clear headed and objective when making decisions about competing demands for scarce financial resources.

About this statement

Aims

This statement focuses on the skills and values that all CFOs working in the NHS should possess and the core activities that they carry out. It deliberately identifies generic tasks without reference (as far as possible) to ‘topical’ policies and processes. The principles of this statement are applicable to both CFOs holding board positions and those who do not work directly with an NHS board, for example, those who lead and form part of the arm’s length bodies’ finance teams.

The statement’s primary aim is to provide existing and aspiring CFOs with an authoritative but concise analysis of what the role involves, the skills and values they need and the part they play in ensuring the success of an NHS organisation while providing a world class finance service in a period of unprecedented challenge and change. Individuals can also use it to assess their personal development needs and influence the way that their role evolves.

The statement will also be helpful in informing others about the role – for example, it will help chairs, board members and other stakeholders to better understand what the CFO does and why they are critical to the success of an NHS organisation. Although it is written from the perspective of the NHS in England the principles set out apply equally to CFOs working in Northern Ireland, Scotland and Wales.

Status

This draft statement supersedes the one that the HFMA issued in 2017 and takes account of other relevant guidance issued since then. The draft statement will be finalised at the end July 2024 and the HFMA welcomes any comments for consideration to be sent to [email protected].

We hope that the statement will remain relevant and helpful for some time to come but will keep it under review and update it as and when necessary.

What being a chief finance officer involves

The CFO role has always been challenging and is becoming more so in the current financial climate. The introduction of system working and the management of system financial envelopes, has added an extra level of complexity into a role that was already multi-faceted. Responsibilities are varied, ranging from statutory duties relating to accountability, governance and probity; ‘traditional’ treasurer activities; corporate strategic management; day-to-day operational management; and stewardship of public sector resources.

In many ways, the role of the NHS CFO mirrors that of CFOs in large commercial organisations – as well as fulfilling their traditional financial accounting and control role, they are expected to be effective board members.

CFOs must ensure that finances are used well and are focused on delivering objectives; that investment plans are analysed thoroughly and properly and that the finance function adds value to the organisation. Of particular importance is the need to maintain financial viability and focus on delivering ever increasing value for patients via a financially sustainable local health system. In addition, best value for taxpayers must be delivered while meeting the overall objective of the NHS to deliver safe high-quality healthcare. As all members of the board are equally responsible for all aspects of performance, CFOs are also responsible for the quality of care provided.

The relative balance of activities within a particular CFO’s role will vary according to the size, type and structure of the organisation they work for and the skills and experiences of other members of the board and management team. The CFO often has a wide portfolio taking in areas outside their immediate technical expertise – for example, information technology or estates. Therefore, the range and depth of competencies required will depend on the specific circumstances and job content.

As well as local considerations, the role changes continually as new policies, services, organisational structures and processes are introduced. Change goes with the territory and inevitably affects the day-to-day activities of an NHS CFO. As a result, they must be:

- effective leaders: playing a full, active and constructive part as a member of the board and executive/ management team and commanding respect across the organisation and the wider health and social care economy

- resilient and clear headed: focusing on the statutory responsibility to safeguard public money while able to handle being in the spotlight. The CFO must always consider if something is actually affordable or whether better alternatives are available. There are times when the CFO simply has to say no, even when outvoted. It is vital to deliver an honest and true assessment of the financial position, even when this is not what anyone wants to hear - being ready and able to propose and implement tough actions, that may be unpopular within some parts of an organisation or the wider system. These qualities are particularly important given the ever-increasing politicisation of the service; the relentless attention of the media and heightened public and patient expectations

- adaptable: able to anticipate and handle changes in circumstances and in the demands placed on them and assume other responsibilities as needed - for example, some CFOs may be leading service transformation programmes

- far sighted: able to think long term and plan within and across organisational boundaries, supporting the wider system

- innovative: able to identify new and better ways of doing things for the benefit of the patient and being willing to take controlled and quantifiable risks without compromising quality

- outward looking: receptive to new ways of working and able to develop and maintain good relationships with other organisations within the local health and care system

- team players: able to see others’ perspectives and work with them for the good of the organisation or wider health economy while ensuring that colleagues understand the full financial implications of their plans and decisions

- good role models: able to inspire loyalty and commitment amongst finance staff and others and establishing an environment in which staff can develop and achieve their full potential

- highly motivated and passionate: even when delivering consistently difficult messages

- technically competent: recognising the importance of maintaining and developing financial skills and competencies. In particular, being willing to acquire new skills and learn from others so that the finance function can meet challenges as they arise.

Dealing with constant change while fulfilling a demanding role is challenging for anyone – however, the skills and experience of a typical CFO along with their values and personal attributes mean that he or she is well equipped to take things in their stride.

Possessing the right values, skills and personal characteristics and being able to carry out the wide range of roles attached to the post are essential attributes for a good CFO. This statement therefore focuses on these four core areas:

- values

- qualifications, experience and practical skills

- personal characteristics

- key roles.

Appendix 1 summarises the activities for each key role, with appendix 2 giving further details.

Essential CFO attributes – values

First and foremost, the CFO must understand and support the principles and values of the NHS set out in the NHS constitution.

Principles

- the NHS provides a comprehensive service, available to all

- access to NHS services is based on clinical need, not an individual’s ability to pay

- the NHS aspires to the highest standards of excellence and professionalism

- NHS services must reflect the needs and preferences of patients, their families and carers

- the NHS works across organisational boundaries and in partnership with other organisations in the interests of patients, local communities and the wider population

- the NHS is committed to providing best value for taxpayers’ money and the most effective, fair and sustainable use of finite resources

- the NHS is accountable to the public, communities and patients that it serves.

Values

- working together for patients: Patients come first in everything we do. We fully involve patients, staff, families, carers, communities, and professionals inside and outside the NHS. We put the needs of patients and communities before organisational boundaries. We speak up when things go wrong.

- respect and dignity: We value every person – whether patient, their families or carers, or staff – as an individual, respect their aspirations and commitments in life, and seek to understand their priorities, needs, abilities and limits. We take what others have to say seriously. We are honest and open about our point of view and what we can and cannot do.

- commitment to quality of care: We earn the trust placed in us by insisting on quality and striving to get the basics of quality of care – safety, effectiveness and patient experience – right every time. We encourage and welcome feedback from patients, families, carers, staff and the public. We use this to improve the care we provide and build on our successes.

- compassion: We ensure that compassion is central to the care we provide and respond with humanity and kindness to each person’s pain, distress, anxiety or need. We search for the things we can do, however small, to give comfort and relieve suffering. We find time for patients, their families and carers, as well as those we work alongside. We do not wait to be asked, because we care.

- improving lives: We strive to improve health and wellbeing and people’s experiences of the NHS. We cherish excellence and professionalism wherever we find it – in the everyday things that make people’s lives better as much as in clinical practice, service improvements and innovation. We recognise that all have a part to play in making ourselves, patients and our communities healthier.

- everyone counts: We maximise our resources for the benefit of the whole community, and make sure nobody is excluded, discriminated against or left behind. We accept that some people need more help, that difficult decisions have to be taken – and that when we waste resources we waste opportunities for others.

All these principles and values are reinforced by the duty of candour that requires all NHS staff and organisations to be honest, open and truthful in all their dealings with patients and the public. Introduced following the Francis Inquiry into the failings at Mid Staffordshire NHS Foundation Trust, the duty of candour is one of the Care Quality Commission’s (CQC) fundamental standards of quality and safety; it must be met by every provider on an on-going basis.

One NHS Finance has developed the NHS’ values into six underpinning values for the finance profession.

- fair: we will be consistent and fair in the way our people are treated by creating a more inclusive environment and treating each other well

- patient-focused: we will connect with the people and services we provide to improve quality and enable better decision-making

- collaboration: we will collaborate across organisations, systems and nationally to share knowledge, ideas, experiences and solutions

- innovation: we will harness the experience and ideas from our finance community to identify improvements in working practices and help to develop new ideas

- inclusion: we will continuously strive to be better by nurturing and supporting all staff at each stage of their career. Our finance function will be a place where everyone feels comfortable bringing their authentic selves to work

- accountability: we measure ourselves against the highest standards of integrity and fiscal responsibility and are responsible for our words, actions, and results.

Above all, finance staff, led by the CFO, should have a fierce pride in working to the highest possible standards. As the CFO depends on his or her team to deliver a professional service, it is also essential that there are sufficient finance staff with the necessary qualifications and experience. Good evidence of this is accreditation by One NHS Finance (ONF). Through the accreditation process, finance departments demonstrate their commitment to the development of finance skills across their workforce.

CFOs must also be aware of (and adhere to) a number of other codes and standards including those relating to disciplinary procedures set by their own professional accountancy bodies.

This includes the International code of ethics for professional accountants,

‘sets out fundamental principles of ethics for professional accountants, reflecting the profession’s recognition of its public interest responsibility. These principles establish the standard of behaviour expected of a professional accountant.’

The Code establishes the five fundamental principles of integrity, objectivity, professional competence and due care, confidentiality and professional behaviour.

The HFMA has its own ethical code

The HFMA has also published a briefing, Ethical standards: roles and responsibilities of the NHS accountant.

Also of importance are Nolan’s seven principles of public life

The assessment of a fit and proper person can be supported by the use of the NHS leadership competency framework for board members

Figure 1: Policy and guidance to support NHS leadership

The six leadership domains set out in the leadership framework are:

- driving high-quality and sustainable outcomes: The skills, knowledge and behaviours needed to deliver and bring about high quality and safe care and lasting change and improvement – from ensuring all staff are trained and well led, to fostering improvement and innovation which leads to better health and care outcomes.

- setting strategy and delivering long-term transformation: The skills that need to be employed in strategy development and planning, and ensuring a system wide view, along with using intelligence from quality, performance, finance and workforce measures to feed into strategy development.

- promoting equality and inclusion, and reducing health and workforce inequalities: The importance of continually reviewing plans and strategies to ensure their delivery leads to improved services and outcomes for all communities, narrows health and workforce inequalities, and promotes inclusion.

- providing robust governance and assurance: The system of leadership accountability and the behaviours, values and standards that underpin our work as leaders. This domain also covers the principles of evaluation, the significance of evidence and assurance in decision making and ensuring patient safety, and the vital importance of collaboration on the board to drive delivery and improvement.

- creating a compassionate, just and positive culture: The skills and behaviours needed to develop great team and organisation cultures. This includes ensuring all staff and service users are listened to and heard, being respectful and challenging inappropriate behaviours.

- building a trusted relationship with partners and communities: The need to collaborate, consult and co-produce with colleagues in neighbouring teams, providers and systems, people using services, our communities, and our workforce. Strengthening relationships and developing collaborative behaviours are key to the integrated care environment.

Essential CFO attributes – qualifications, experience and practical skills

CFOs in the NHS must be qualified accountants who are members of either the Chartered Institute of Management Accountants (CIMA) or a member of one of the five accountancy institute members of the Consultative Committee of Accountancy Bodies:

- Chartered Institute of Public Finance and Accountancy (CIPFA)

- Institute of Chartered Accountants in England and Wales (ICAEW)

- Institute of Chartered Accountants of Scotland (ICAS)

- Institute of Chartered Accountants of Ireland (ICAI)

- Association of Chartered Certified Accountants (ACCA).

To evidence a broader understanding of finance and managerial issues, a level 6 or 7 qualification, for example, a master’s degree in a relevant area is also desirable.

CFOs should also have experience across a wide range of the finance function’s responsibilities - for example, financial and management accounting; capital and investment appraisal; commissioning; financial performance management; budgeting/budgetary control; financial planning; costing/ financial analysis; financial systems; audit; payroll, and significant post-qualification experience holding senior positions in the public and/or private sector.

As well as being suitably qualified and having relevant experience, CFOs need practical capabilities and technical knowledge. The National Finance Academy network identified the following practical skills and competencies as being particularly important

- communicating, influencing and negotiating

- team working and collaborating

- working across the system

- leading change and personal development

- being accountable

- solving problems and making decisions

- planning and organising

- challenging and innovating

- governance and managing risk

- using IT.

In addition, our members recognise the importance of relevant experience in terms of counter fraud, security management and procurement.

CFOs must also maintain and develop their knowledge and skills and stay abreast of emerging technologies and techniques. This is achieved both through participation in continuing professional development (CPD) and by other means - for example, by being an active member of the HFMA and/or their accountancy body. The precise requirements for CPD vary between accountancy bodies but all CFOs must participate in the relevant scheme and ensure that all their qualified staff and accounting technicians do the same.

CFOs also have a responsibility for the future of the profession and a key role in helping to develop staff across their local areas.

Essential CFO attributes – personal characteristics

In the introduction to this statement, we highlighted a number of character traits that today’s CFO needs to possess – resilience, adaptability and far sightedness. We also pointed out that he or she must be innovative, outward looking, an effective leader, team player and role model.

The NHS Leadership Academy has published Our leadership way

- we are compassionate

• we are inclusive, promote equality and diversity and challenge discrimination

• we are kind and treat people with compassion, courtesy and respect - we are curious

• we aim for the highest standards and seek to continually improve harnessing our ingenuity.

• we can be trusted to do what we promise - we are collaborative

• we collaborate, forming effective partnerships to achieve our common goals

• we celebrate success and support our people to be the best they can be.

System leadership is increasingly important and a CFO will need to understand the priorities of other statutory organisations as well as their own. Having done so, the CFO will need to recognise the priorities for the system as a whole and support or lead system-wide solutions.

Understanding the system in organisational terms is important, but equally important is an understanding of how healthcare works in the wider economic, social and environmental systems. For example, if local decisions can improve air quality, the local NHS body will benefit from reduced admissions relating to chest and breathing difficulties. The CFO will make decisions that have the potential for either positive or negative impacts both on the local organisation and the wider economic, social and environmental systems.

The specific nature of a particular CFO’s role and the organisation’s style and approach will determine the relative importance of these qualities but all are needed to some degree.

In practice, CFOs need to be able to respond to different situations using a variety of skills, behaviours and knowledge from across their competency ‘toolkit’. They also need to modify their behaviour and approach to suit new ways of working and to ensure continuing delivery of financial duties and other targets.

Essential CFO attributes - key roles

In the HFMA’s view, a CFO’s core activities can be grouped under six broad headings:

- corporate leadership, management and decision-making

- stewardship and accountability

- financial management

- commercial skills

- professional leadership and management

- working with partners.

These headings are broadly consistent with the ‘core CFO responsibilities’ set out in CIPFA’s 2023 pan public sector statement – The role of the chief financial officer in public service organisations.

In this section, we will look at each core role and:

- explain why it is important

- identify in broad terms what it involves.

Examples of key activities for each role are shown in appendix 2.

Role 1: corporate leadership, management and decision-making

Why this role is important

In all NHS organisations, the CFO must be a member of the board. The Treasury’s guide, Managing public money

Although, in the NHS, ultimate statutory responsibility and accountability for financial duties rests with the accountable/ accounting officer,

The board, management team, clinicians and others need to understand the financial implications of their strategic and service delivery plans and be aware of financial performance. It is the CFO who is responsible for meeting these needs and for providing support for strategic decision-making, financial leadership and guidance.

What this role involves

To be effective in this role, CFOs must earn the respect of their colleagues on the board/ management team by playing a full and constructive part in proceedings; balancing corporate and more ‘traditional’ finance responsibilities and ensuring that decisions are taken based on sound and thorough analyses. It is therefore important for the CFO to form a view and do their own thinking on all manner of issues in order to share their ideas, knowledge and opinion as needed.

Typically, this role involves:

- contributing to the organisation’s overall management and leadership by playing a full, active and constructive part on the board and the executive/ management team and being a valued and well-respected member of each

- playing a leading role in devising and implementing the organisation’s operational planning processes to ensure that strategic objectives are cascaded down to all levels and that plans are realistic and achievable

- contributing to the development and maintenance of the organisation’s overall governance framework (including the development of effective controls, a robust and integrated approach to risk management and a meaningful assurance framework)

- ensuring that the impact on the quality of healthcare services and patient safety is understood when reaching decisions in general and considering the associated financial implications in particular

- contributing to the development and maintenance of good relationships with all partners, internal and external stakeholders. This may include leading system change and requires an exceptional level of political astuteness alongside a wide perspective and a willingness and capacity to forge effective and durable relationships

- providing expertise and advice to the board and executive/ management team on finance related issues to support and facilitate effective strategic thinking and decision-making. This will include getting to the root cause of performance issues; providing advice relating to change management; business and commercial activities; financial strategy, planning and performance and investment appraisal

- ensuring that the organisation’s finances are managed wisely and well and effectively deployed. CFOs are ‘moral guardians’ as they have the greatest influence in this regard.

This role is particularly challenging but no less vital for those CFOs who fulfil the role for more than one organisation and must manage competing priorities.

Role 2: stewardship and accountability

Why this role is important

With regular change the norm in the NHS, there can be a tendency to focus on the demands of the latest policy announcement and lose sight of the need to safeguard resources, provide quality healthcare to meet demand and demonstrate probity. CFOs play a key role in ensuring that this does not happen. Although it is the accountable/accounting officer who is formally responsible for the ‘proper stewardship of public money and assets’ it is the CFO who has day-to-day responsibility in this area and who has a key role to play in demonstrating accountability to patients, the local public, the Public Accounts Committee and other stakeholders. Similarly, although statutory responsibility for internal control rests with the board and accountable/ accounting officer, the CFO is closely involved in providing assurance to stakeholders that effective controls are in place and working as they should.

In short, CFOs must not lose sight of the fact that stewardship and accountability is a fundamental part of their role.

What this role involves

Typically, this role involves:

- stewardship of public money – knowing the business thoroughly and demonstrating probity in the use of resources; ensuring that they are safeguarded at all times (through effective systems of control), that they are used wisely and well and in line with prevailing legislation, rules and regulations; ensuring that there is an effective approach to financial risk assessment and mitigation

- being prepared to raise concerns/ report suspected fraudulent behaviour/ disclose irregularities in accordance with the Public Interest Disclosure Act 1998,

The UK Government, Public Interest Disclosure Act 1998, 1998 states that a qualifying disclosure, and any allegation contained in it, must be substantially true. the Bribery Act 2010The Bribery Act 2010 makes it an offence to accept gifts or hospitality as an inducement or reward for doing something in a public role. It applies to both organisations and individuals and means that NHS bodies must ensure that they have in place adequate systems to prevent bribery. and other relevant guidance - demonstrating accountability for the use of resources/ public money through meaningful financial reports that are fit for audience and purpose; an effective internal audit service that is valued and resourced properly; financial accounting that is rigorous and carried out in line with statutory and regulatory requirements; constructive working relationships with external auditors, regulators, inspection agencies and other stakeholders.

It is important to note that CFOs are responsible for the adequacy of the control environment irrespective of how financial services are provided. For example, CFOs in organisations that use shared services need to ensure that adequate safeguards exist in contracts to ensure that public funds are being used effectively and appropriately. Similarly, CFOs must ensure that sound financial systems and controls are in place to monitor ‘non-direct’ spending - for example, through contracts and personal health budgets, and ensure that resources are accounted for and spent properly.

Role 3: financial management

Why this role is important

In The role of the chief financial officer in public service organisations,

What this role involves

Typically, this role involves:

- championing financial management – ensuring that the importance of good financial management and what it means in practice is recognised and understood throughout the organisation

- using financial management skills to deliver financial insight to partners, service users and colleagues

- ensuring that an organisation’s approach to financial management suits its circumstances, structures and aims

- ensuring that the financial management regime is comprehensive and supports innovation, improvement and delivery of high quality healthcare

- ensuring that budget holders have the skills and information they need to carry out their roles

- formulating, implementing and monitoring the organisation’s financial strategies/ plans

- ensuring compliance with national and local guidelines, duties and targets.

Role 4: commercial skills

Why this role is important

Given the environment within which CFOs work, with the need to ensure patient centred health and social care and deliver value for money while avoiding anti-competitive actions and facilitating the integration of services, commercial awareness and business skills are key attributes. The CFO must balance commercial skills with doing what’s right for the patient and wider healthcare system.

What this role involves

Typically, this role involves:

- making the case for change - understanding current priorities and drivers for economic and service transformation including the creation of best value by segmenting and differentiating services to ensure delivery of the desired outcomes for patients and the wider health economy

- maximising funding sources

- business-like thinking

- developing partnerships with other organisations (internal and external to the NHS) including negotiating contracts

- responding to tenders and developing proposals for new business, often over the medium to long term

- implementing sustainable techniques for improving efficiency, effectiveness and the utilisation of resources

- demonstrating the value of policy and operational changes, focusing on outcomes

- maintaining up to date knowledge of procurement rules and guidance to ensure that the organisation is compliant in its actions

- ensuring that money spent through contracts is managed to the standards expected for public funds.

Role 5: professional leadership and management

Why this role is important

Although it is important that all senior managers (executive and non-executive) are financially literate, the CFO plays a key role in establishing the overall financial tone and culture. It is therefore important that the CFO has the right qualifications, experience and skills; that he/ she commands respect across the organisation; and is a role model for finance staff, inspiring their loyalty and commitment.

Professional personal conduct and setting, achieving and expecting the highest possible professional standards are also essential. This applies both within the organisation and across organisational boundaries, for example, where there are shared financial services or collaborative working. As CFOs depend on others to deliver a professional service, it is also important to create an atmosphere in which staff can thrive and professional values can prosper; individual members of staff need to feel valued and be given the opportunity to develop. They also need to feel able to raise any issues or concerns without fear of criticism or reprisal.

What this role involves

Typically, this role involves:

- ensuring that there are high professional standards throughout the finance function and that it operates effectively

- leading and managing the finance function well

- ensuring that finance staff are well trained and have opportunities to develop and grow and that the organisation has sufficient, appropriately skilled staff who are committed and enthusiastic. CFOs have a responsibility for the future of the profession and have a role in helping to develop staff across their local areas

- ensuring that the functioning of the finance department is reviewed regularly with a view to maintaining high standards and looking for opportunities to improve and ‘connect’ with other disciplines and professionals

- demonstrating (to a wide audience) well-considered thought leadership and being exceptional ambassadors for the professionalism of the function as a whole.

Role 6: working with partners

Why this role is important

The Health and Care Act 2022

What this role involves

Typically this role involves:

- managing the balance between organisational and system priorities, which may not always align

- ensuring organisational financial sustainability while simultaneously supporting the system financial position

- developing and enabling openness and transparency between system partners

- fostering a culture of collaboration

- working with partners to develop system approaches to local challenges which benefit patients, but which may result in a change of activity for the CFO’s own organisation

- tackling the ambiguity and uncertainty that surrounds significant change and supporting the finance function to remain engaged and effective

- building and maintaining effective relationships across all system partners.

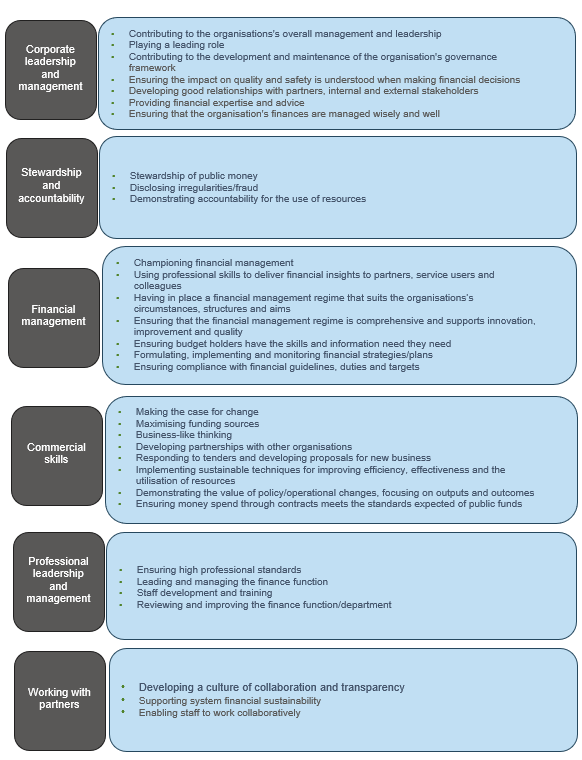

Appendix 1 – Summary diagram of the key roles and example activities of the CFO

Role of the CFO

Appendix 2 – Key CFO roles: examples

This appendix gives examples of activities that fall under each of the CFO’s five key roles – it is not intended to be an exhaustive listing. Please note that activities are identified under what we consider to be the ‘dominant’ role, however, in some instances there is a degree of overlap and duplication. It is also important to bear in mind that although in practice many day-to-day tasks and activities will be delegated to other members of the finance team, the CFO remains ultimately responsible.

Role 1: corporate leadership and management example activities

Contributing to the organisation’s overall management and leadership

|

Playing a leading role in operational planning

|

Contributing to the development and maintenance of the organisation’s governance framework

|

Ensuring that the impact on quality and safety is understood when reaching decisions

|

Developing good relationships with partners, internal and external stakeholders

|

Providing financial expertise and advice

|

Ensuring that the organisation’s finances are managed wisely and well

|

Role 2: stewardship and accountability example activities

Stewardship of public money

|

Disclosing irregularities/ fraud

|

Demonstrating accountability

|

Role 3: financial management example activities

Championing financial management

|

Using financial management skills to deliver financial insights to partners, service users and colleagues

|

Having in place a financial management regime that suits the organisation’s circumstances, structures and aims

|

Ensuring that the financial management regime is comprehensive and supports innovation, improvement and quality

|

Ensuring that budget holders have the skills and information they need to carry out their roles

|

Formulating, implementing and monitoring financial strategies/plans

|

Ensuring compliance with financial guidelines, duties and targets

|

Role 4: commercial skills example activities

Making the case for change

|

Maximising funding sources

|

Business-like thinking

|

Developing partnerships with other organisations

|

Responding to tenders and developing proposals for new business in the UK and further afield

|

Implementing sustainable techniques for improving efficiency, effectiveness and the utilisation of resources

|

Demonstrating the value of policy and operational changes, focusing on outcomes

|

Ensuring that money spent through contracts is managed to the standards expected for public funds

|

Role 5: professional leadership and management example activities

Ensuring high professional standards

|

Leading and managing the finance function

|

Staff development and training

|

Reviewing and improving the finance function/ department

|

Role 6: working with partners example activities

Developing a culture of collaboration and transparency

|

Supporting system financial sustainability

|

Enabling staff to work collaboratively

|

Related content

This webinar series offers colleagues of ICS organisations the opportunity to discuss common priorities, challenges, and successes within their field.

We are excited to bring you a fun packed Eastern Branch Conference in 2025 over three days.