Technical / Technical review June 2017

The apprenticeship levy scheme, which started in April, requires all employers with a paybill of more than £3m a year to contribute at a rate of 0.5% of their paybill minus a £15,000 allowance. Payments go into each employer’s own digital apprenticeship account along with a government top-up. Employers can then access these funds for up to two years to support approved vocational training.

It has been unclear how employers account for payments into and withdrawals from their accounts – with the HFMA’s Accounting and Standards Committee last year identifying three possible approaches. The major accountancy firms are understood to have reached a consensus – Deloitte has published a proposal, with others expected to follow suit.

The Deloitte guidance suggests different treatments depending on whether employers plan to enter into eligible apprenticeships or not. When paying into accounts, those expecting to use funds should recognise a prepayment for training services expected to be received. These payments are recognised as an asset until the receipt of service. When the service is received, an appropriate expense should be recognised. Employers not intending to offer apprenticeships within the 24-month life of the funds should treat the payments as an expense. Payments relating to staff in Wales, Scotland and Northern Ireland must also be expensed. Deloitte adds that government top-ups (10% as standard and a 90% co-investment in set conditions) should be recognised as grant income at the same time that an associated expense for training services is recognised.

The approach has not been officially confirmed yet and NHS bodies will have to follow whatever guidance is issued by the Department of Health, NHS Improvement and NHS England. NHS Improvement guidance on filling in the planning forms should be followed until it says otherwise.

NHS England has also set up codes to allow clinical commissioning groups to deal with the payment of the levy. The HFMA’s Accounting and Standards Committee is in discussion with all of these bodies and will develop a briefing that is expected to include worked examples.

New HFMA guidance offers help to governing body and audit committee members when reviewing financial reports during the year and at the year end. The guidance is organised as a series of questions non-executives and lay members might ask about annual accounts and periodic reports, also explaining the underlying reason for asking it. Questions are grouped under six headings:

- Overall performance

- Accounts preparation

- Statements of comprehensive income/net expenditure

- Statement of changes in taxpayer equity

- Statement of financial position

- Statement of cash flows.

For example, in terms of expenditure it directs non-executives to ask about meaningful changes in depreciation figures. It explains that changes in the useful economic lives of assets may reduce in-year expenditure without a corresponding improvement in cash.

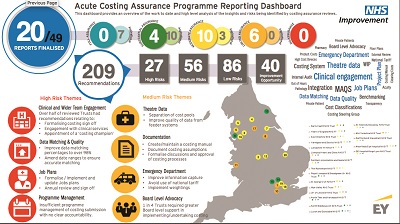

NHS Improvement has provided a summary of messages emerging from this year’s acute costing assurance programme. Using a dashboard, the oversight body has provided feedback from 20 of 49 reports and highlighted 209 recommendations, including 40 improvement opportunities and 27 high-risk themes.

One high-risk area was where auditors found insufficient programme management of costing submissions with no clear accountability. Of the 20 bodies audited, four were rated as having substantial assurance, 10 moderate and six limited assurance.

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.