News / Sustainability questions

Sustainability and transformation plans (STPs) will provide the NHS with an effective lever to gain acceptance of proposals for changing local services, according to the latest HFMA NHS financial temperature check. But there was concern over governance of the regional bodies and caution over the levels of savings they can achieve quickly.

The HFMA received responses from 128 provider finance directors (54%) and 73 clinical commissioning group chief finance officers (35%). Finance directors completed the survey in late October and early November.

Survey respondents broadly supported the STP process and 46% said relationships between commissioners and providers had improved.

Almost 60% of respondents said they could see clear and effective STP leadership in place. However, only 20% felt relationships were strong enough in their STP to make the necessary changes across organisational boundaries.

There were fears over the scale of expectation and the consequent financial risk. Respondents did not believe there was enough clarity on accountability for implementation and 72% were concerned about STP governance.

A majority of finance directors (62%) would prioritise their own organisation’s obligations ahead of the STP’s objectives if there was a conflict between the two. This may reflect the lack of clarity on the authority of STPs and how they relate to boards’ statutory duties and financial control totals.

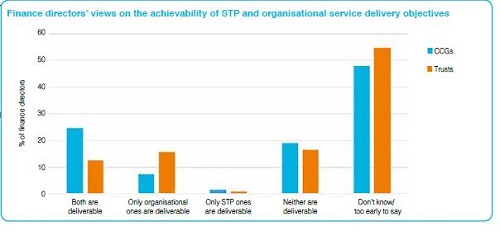

Many finance directors believed the financial goals set for the STP process are too optimistic and only 54% believed that the financial risks associated with STPs have been fully recognised. While accepting that STPs are young organisations, more than a quarter of finance directors questioned whether the STP financial objectives could be delivered. Though most thought it too early to say, 6% of trust finance directors and 17% of CCG finance leads were confident that organisational and STP financial goals would be delivered.

The chief concerns were on the pace of change required and the high-risk nature of the plans. Respondents also questioned whether local politicians would back the necessary changes.

The HFMA said local finance leaders were appealing for realism, with only 5% feeling adequate risk management processes were currently in place. Respondents had highlighted a number of risks to their STP, many of which they also regarded as threats to their organisations, including increases in emergency care activity; the impact of financial constraints on social care; rising demand; slippage in cost savings programmes; and delayed discharges.

According to the survey, 82% of finance directors favoured a change in the regulatory regime to support STP delivery, with 79% backing changes to the financial regime, and many questioning the value of tariff funding.

‘Although STPs were met with enthusiasm and positivity when they were introduced, there is scepticism from finance directors that the STP frameworks can work in practice,’ said Paul Briddock, HFMA director of policy.

‘It is encouraging to see reported improvements in collaboration and some strong leadership in place, but when operating in a “club versus country” framework, where there are conflicting priorities between individual organisations and footprint areas, the lack of clear governance can cause angst.

‘Given that it is early days, many organisations are yet to strike the right balance and there are clearly still issues that will need to be worked through, but doing this in an open and transparent manner will be key to achieving the success we need to see across NHS finance.’

The survey also asked trust and CCG finance leads about the financial position of their organisations. In the quarter two figures from NHS Improvement, the provider sector reported a combined deficit of £648m, having received £900m from the sustainability and transformation fund. In their half-year figures, CCGs had a year-to-date overspend of almost £236m against plan.

The HFMA said organisations in all sectors of the NHS are facing significant financial pressure. While the problems in the provider sector are well established, CCGs are also now forecasting an overspend of £190m, according to Q2 figures.

The temperature check survey showed 52% of trusts forecast a deficit this year – NHS Improvement expects 50% (118 trusts) to end the financial year with a deficit. This would be an improvement on 2015/16, when 65% recorded a deficit. The provider sector is, of course, planning for an overall deficit this year, with some organisations also planning for a deficit.

In the HFMA survey, more than half of CCGs (56%) forecast a surplus at year-end, 21% a deficit. They are required by NHS England to make a minimum surplus of either 1% of allocation or their 2015/16 surplus less agreed drawdown, whichever is greater. Some 51% of CCGs told the HFMA that their 2016/17 forecast would reduce their brought-forward surplus.

The HFMA survey said that while most NHS bodies expect their year-end position to be the same as or better than planned, 22% of trust finance directors and 35% of CCG finance officers believe it will be worse.

And 31% of respondents did not expect to keep within their control totals. Some 85% of finance directors did not believe the financial reset, launched in the summer, would return the NHS to financial balance in the short term. Some commented that the plan would cut the deficit, but it was felt that the underlying deficit was too large to return to balance in the short term. The NHS needed longer to address the challenges of increasing demand, reducing the cost base and balancing the financial position of commissioners and providers.

Finance directors’ confidence on being able to meet their control totals was tempered by the lack of headroom in the current financial year. They said forecasts were tight and their delivery depended on the severity of winter pressures, the achievement of cost improvement programmes, inter-organisational agreements and the use of non-recurrent funds. They noted the need to balance the agreed financial position with consequences for services to patients.

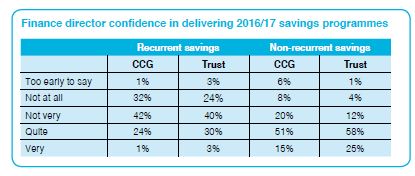

In the survey, 57% of CCG chief finance officers and 39% of trust finance directors considered the level of risk to be high. At the same time, confidence in their organisations’ ability to deliver planned recurrent savings was low. Finance leaders had more confidence in their non-recurrent savings plans.

Achieving planned savings have proved elusive and was the main factor contributing to a rise in provider costs – 61% of trust finance directors identified underachievement of planned savings as a key cause of variance between their forecast and plan. According to the Q2 figures from NHS Improvement, providers delivered £1.2bn of savings in the first six months of 2016/17, but 75% (£894m) was based on recurrent savings – they had planned recurrent schemes to deliver £1.17bn in the first half of the year.

An increase in agency staff costs was another reason given to the HFMA for provider forecasts varying from plan (34%), along with rises in planned non-pay costs (24%) and increasing fines, challenges and deductions.

NHS Improvement said 71% of trusts have cut their agency spending since new rules to curb temporary staff expenditure were introduced last November. At Q2, agency costs were £312m lower than at the same point 12 months earlier. However, the pay bill was £71m over plan, drugs and clinical supplies overspent by £62m each.

The HFMA said CCG finance chiefs were most concerned about acute hospital contract costs (82%), the cost of funded nursing care (74%) and the underachievement of planned savings (also 74%).

The biggest threat to in-year financial balance is believed to be the increasing emergency admissions, together with other rises in demand and the financial constraints in social care. CCGs also said loss of access to their non-recurrent reserves would threaten their financial balance.

The temperature check report said welcome steps had been introduced to help the NHS achieve financial sustainability and improve its operational performance. These included the £1.8bn sustainability and transformation fund, the two-year planning guidance for 2017/19 and the planning timetable being brought forward.

Looking into 2017/18, just over half of trust finance directors predicted their organisation will be in deficit and the proportion forecasting a 2017/18 surplus was 35%, compared with 45% in 2016/17. A quarter of CCG chief finance officers are forecasting a deficit in 2017/18.

There is uncertainty about control totals for 2017/18 and 2018/19. A third of those accepting totals believe them to be achievable and 19% unachievable, while 48% did not know. Some finance directors were concerned the control totals were unrealistic and did not reflect the scale and pace of change needed to enable significant transformation programmes across a number of organisations.

Concern remains over quality of care, with 25% of trust finance directors and 22% of their CCG colleagues believing it is deteriorating in the current financial year. Almost half (47%) of trust finance directors and nearly a third (32%) in CCGs said it will decline further in 2017/18. While few directors believed clinical outcomes or patient safety were at risk, they were concerned about access to care, waiting times and rationing.

Mr Briddock said the NHS was in a difficult position – discussion was needed on its finances and expectations had to be more realistic.

‘Finance directors are calling for more realism across the sector, and a frank discussion as to what services are affordable in future. The current numbers don’t add up and are merely a sticking plaster on a much bigger problem. Despite the NHS agreeing that initiatives such as STPs provide the platform for achieving a more financially balanced NHS, further conversations and collaboration are needed.’Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.