NHS in numbers: deficits

The NHS long-term plan commits the NHS to returning to financial balance. It says that the service will continue to achieve financial balance across providers and commissioners as a whole. However, within this, it commits to achieving balance across the provider sector in 2020/21, with all NHS organisations individually in balance by 2023/24.

This is no simple task, even with funding expected to rise by £20.5m in real terms over this time frame.

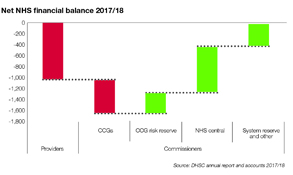

The NHS ended 2017/18 with an almost balanced position across providers and commissioners, with providers’ net deficit of £991m almost balanced by a combined underspend across all commissioners of £970m – leaving a small £21m deficit.

Achieving balance has been increasingly difficult in recent years and its continued achievement remains the minimum requirement.

Achieving financial balance across the provider sector looks altogether a more difficult challenge. Collectively providers’ nearly £1bn deficit in 2017/18 was £500m over plan and included the benefit of a £1.8bn sustainability and transformation fund (STF). Their underlying deficit is even higher at £1.85bn.

Of 234 providers in 2017/18, 105 had planned to make a collective deficit of £1.6bn, which should have been offset by the 129 providers making a surplus of £703m (plus £404m of uncommitted STF).

In fact, the outturn position showed an improvement in the number of providers reporting deficits. But the 101 deficit trusts reported a significantly increased deficit of £2.4bn, albeit offset by an improved collective surplus of £1.3bn across the 133 surplus providers (with a further £105m of adjustments delivering the overall net provider deficit).

The National Audit Office’s financial sustainability report in January underlined how a small number of providers are responsible for most of the problem. Just 10 of the worst-performing trusts reported a combined deficit of £758m – 69% of the net trust deficit (before central adjustments). However, this only represents just over 30% of the gross deficit shared by all deficit trusts. According to NHS Improvement’s Q2 report for the current year, there were 155 deficit providers at the halfway point in the year, with 111 forecasting to be in deficit by the year-end. Eleven of the most financially challenged trusts remain in financial special measures.

According to NHS Improvement’s Q2 report for the current year, there were 155 deficit providers at the halfway point in the year, with 111 forecasting to be in deficit by the year-end. Eleven of the most financially challenged trusts remain in financial special measures.

Achieving balance at the individual commissioner level might seem an easier prospect given their overall collective balanced starting point, but this will also be challenging.

Within NHS England’s overall underspend of £1bn for 2017/18, the Department of Health and Social Care’s annual accounts demonstrate that clinical commissioning groups overspent by a total of £0.6bn, reducing to £0.2bn following the release of the CCG risk reserve.The NAO’s analysis shows that this £213m overspend was after underspends on the quality premium programme and technical adjustments. The actual collective overspend on locally commissioned services was £321m, made up of an overspend of £568m by 75 CCGs and an underspend of £247m by 132 CCGs.

This year, even with a £400m commissioner sustainability fund specifically targeted at those CCGs unable to live within their means, some 48 CCGs were reporting year-to-date overspends after eight months, with 15 forecasting to remain overspent at the year-end.Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.