NHS in numbers: capital spending

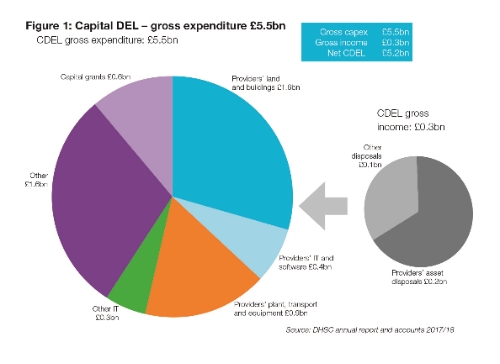

Collectively in 2017/18, bodies in the Department group spent a net £5.2bn on capital, £360m short of the £5.6bn capital departmental expenditure limit (CDEL) – a 6.4% underspend. The budget had already been reduced by £1bn after a Parliament-authorised transfer to the revenue DEL. Gross capital spending – before netting off £300m of income from disposals – was £5.5bn. Providers accounted for £3.1bn, or nearly 60% of total spend, and three-quarters of providers’ capital expenditure was financed from depreciation, cash reserves and loans. More than half this spending was on land and buildings, just under a third on plant, transport and equipment and the remainder on IT and software.

Despite a consensus that capital funding is in short supply, providers underspent their DEL allocation by £267m. According to NHS Improvement, this underspend emerged at month 11, after previous forecasts had suggested an overspend. It said there was no mechanism to return this funding in 2018/19, which would increase pressure on the 2018/19 CDEL budget. The Department of Health and Social Care is working with NHS Improvement to review the capital regime to minimise future underspends.

Further details from the Department about financial assistance show NHS providers had £2.8bn of outstanding capital loans at the end of the year, and paid back more of these loans during the year than the money they drew down.

Some £551m of provider capital spending was financed by non-repayable public dividend capital. This included spending on a range of Department-led initiatives, including A&E reconfigurations (£98m), provider digitalisation (£94m), cyber security (£61m) and the upgrade of linear accelerators (£46m). In the case of the A&E programme, 110 trusts received funds to allow for better assessment of patients when they arrive and to increase the provision of on-site primary care facilities.

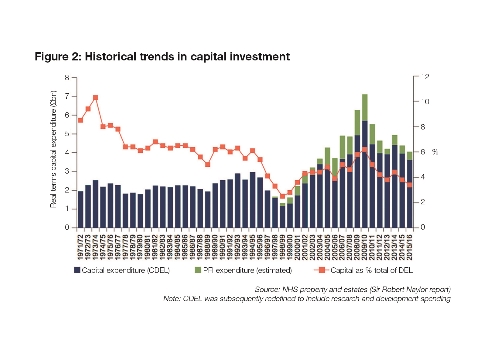

The 2017 Naylor review of the NHS estate showed capital investment had been about £4bn per year over the term of the previous Parliament (excluding primary care estate) – higher than the long-term average. (Subsequent to the Naylor report, CDEL has been redefined to include research and development funding. This increased CDEL by £1bn in 2017/18.)

However, the NHS had still experienced rising backlog maintenance and capital as a percentage of total DEL was declining.

The 2015 spending review settlement held the CDEL flat in cash terms, meaning a real-terms cut over the course of the Parliament. It also suggested £2bn of assets would be sold, releasing land for 26,000 homes and freeing up investment.

The Naylor review estimated sustainability and transformation partnership (STP) capital requirements were about £10bn in the medium term – with £5bn of backlog maintenance and a similar figure needed to deliver Five-year forward view proposals. This would be met from property disposals, private capital (for primary care) and the Treasury. A step to close this gap came with the November 2017 Budget announcement of an extra £3.5bn over five years, with £2.6bn to be delivered through STPs. However, STP capital plans continue to outstrip the available resources.

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.