News analysis: Sustained pressure

Providers’ agency staff spending continued to fall in 2017/18. The total agency spend of £2.4bn represented 4.6% of the overall paybill. This is a significant fall compared with the 5.8% in 2016/17, and well below the recent peak of nearly 8% in 2015/16.

While this brings the service closer to the proportional levels of spend from 2012 and earlier, NHS Improvement believes there is still more progress to be made and has announced a series of further actions on temporary staffing for the year ahead.

Speaking at an HFMA workforce forum in June, NHS Improvement deputy director of agency intelligence Dominic Raymont (pictured) said that agency controls introduced from 2015/16 had had an impact. ‘But the hard work on cost reductions and the credit is all yours,’ he told delegates.

At its worst, agency spending had reached £3.6bn across medical, nursing and other staff categories in 2015/16. ‘Now, trusts have taken £1.2bn from the combined agency bill,’ he said. ‘That is a phenomenal effort.’

Some of that former cost has moved into spend on bank staff – where there was a significant overspend against plan in 2017/18 (see box) – although temporary staff spend overall was still down on the previous year.

This is in line with a major push to get trusts to move from a reliance on agency staff to bank wherever possible, delivering cost savings and often enhancing quality. However, the ultimate goal remains to get temporary staffing spend overall to the optimum level, which will involve a combination of increasing substantive posts where appropriate and possible, getting the demand right and continuing to bear down on temporary staff costs.

Mr Raymont also praised the speed of the turnaround, addressing a problem in two years that had taken four years to build up.

Understandably, the source of savings is changing as trusts have tackled different staff groups in phases. While medical locums accounted for the single biggest chunk of agency cost savings in 2016 (42% compared with 24% for nursing and 34% on other staff categories), medical accounted for less than 20% of savings in the last year.

The service also passed a significant landmark in 2017/18, with spending on bank staff exceeding agency spending for the first time. Bank staff accounted for 5.6% of total staffing spend compared with 4.6% on agency.

However, this split is not mirrored across all staff groups. In medical and dental, spend on agency staff (at 7% of all medical staffing spend) remains higher than bank spend (5%).

Mr Raymont said that the staffing group costing the most in terms of temporary staff as a proportion of overall spend was healthcare assistants. Some 14% of total spend on healthcare assistants went on temporary staff, although the majority of this (12%) was from banks rather than agencies. NHS Improvement will be working with trusts this year where spend on temporary staffing is above the average.

So, the NHS is doing well, with a more sustainable mix of temporary staff beginning to emerge. However, Mr Raymont said there was still ‘much further to travel and too much variation between trusts’. He said, for example, that some trusts’ spend with agencies on medical locums was still in double figures as a percentage of the medical paybill.

Other cost pressures

The new agency ceiling target for 2018/19 is £2.2bn, which implies further savings of £200m this year on top of last year’s outturn agency staff spend. But, in reality, there are other cost pressures. The Agenda for Change pay deal could add an extra £50m to agency staff costs, while growth in activity and vacancy pressures – NHS Improvement said there were 100,000 vacancies across the NHS at Q4 – may add a further £100m.

Add in other inflationary pressures of £50m and the service will actually have to realise savings of £400m to hit its collective target.

NHS Improvement chief executive Ian Dalton wrote to NHS trusts at the end of May, setting out actions they will be required to undertake as part of a further tightening of the regime this year. These include a lowering of the hourly rate threshold at which chief executives are required to sign-off shifts in advance.

This is being lowered from £120 to £100, although it is understood that many trusts already have this lower rate included in their local governance arrangements. Executive directors will now also have to sign off any agency shifts that are 50% or more above the price cap, but where the hourly rate is less than £100. All these ‘breaches’ need to be reported to NHS Improvement in weekly submissions.

Other than that, there will be continued work to reduce the use of off-framework agencies, continued encouragement to use bank over agency staff and further development of collaborative banks.

Martin Innes, senior operational agency data and intelligence lead at NHS Improvement, told the same workshop there were lots of opportunities to make further savings and even modest reductions in rates paid to agencies could have a dramatic impact on overall spend levels.

Agencies have their place particularly in providing staff for one-off requirements. But trusts should explore opportunities to transfer staff working regularly for trusts through agencies onto their own banks. In many cases, this would have no impact on the money received by the worker, but there could be substantial savings in terms of agency and framework fees. Even paying higher pay rates through the bank could lead to savings overall.

Mr Innes said there were some staff members effectively working full-time and long term, but employed through an agency – up to 15 years in the case of one doctor. Even allowing for the costs of administering these arrangements in-house, Mr Innes said there was potential to save substantial sums on individual members of the temporary workforce.

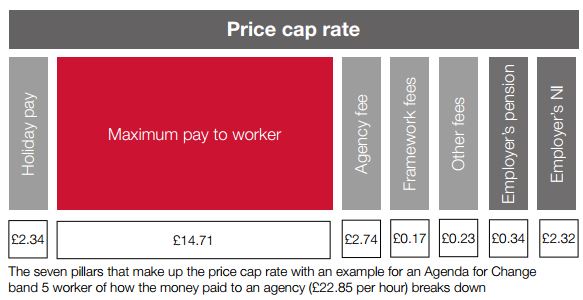

He also reminded trusts there were opportunities for savings even when adhering to price cap rates under in-framework contracts. For a start, the price caps include the maximum pay rate for the worker concerned – the cap rate for a band 5 worker includes the equivalent pay rate for someone at the top of that band.

‘So, someone just one year qualified is not entitled to that rate,’ he said. ‘You should go back to the agency and ask how qualified the nurse is and where they should be in terms of spine points.’ The NHS has had a tendency to accept the maximum pay rate, particularly with nursing staff, Mr Innes said. Changes in the pay component will influence other elements within the overall charge.

Employer national insurance is also allowed for within the cap at a rate of 13.8%. But agencies should only pass on the actual costs of paying these contributions, which is often lower. Pension contributions (based on 3% in the cap) should only be paid if the worker has a workplace pension – many have opted out.

‘Break glass’ provisions

Trusts are allowed to override agency rules using ‘break glass’ provisions. This can involve using off-framework agencies, and Mr Innes warned about the hike in agency fees that typically accompany this. He gave an example of one high-cost agency charging more than double the price cap rate for a band 5 nurse, with only a third of the increase going to the worker. In more extreme cases, with off-framework rates over £100, the worker is often only getting about a third of the overall payment.

He added that trusts typically tended to have a stepped process, particularly where shifts were being filled close to the actual shift time, of: check if shift can be filled by overtime or bank; fill through agency on framework; seek to break glass and use off-framework agency.

In reality, he said there were two further steps that should be tested before moving to off-framework agencies. Trusts should first try to fill the shift by increasing the bank rate and then ask the framework agencies if they can supply if the rate increased. Both of these could still be more cost-effective than off-framework rates.

‘Work with your bank and your on-framework agencies for a solution,’ Mr Innes said.

He stressed that small changes in rates paid could produce significant dividends. ‘Every penny taken off the price of agency medics reduces spend nationally by £101,000. And every £5 off the price of shifts above the cap, we save £35m,’ he said. ‘And if we move every medical shift to cap, we save the NHS £300m.’

With £400m to save this year from already reduced agency spend budgets, every penny counts.

Temporary staff spend in numbers

Providers spent £2,407m in 2017/18 on agency staff. This was, in fact, £93m (3.7%) less than they’d planned to spend, set by the level of their collective agency pay ceilings. The spend was also £527m less than in the previous year – with NHS Improvement describing the 18% fall as ‘impressive’.

However, the £2,974m spending on bank staff was £976m or 49% above plan. Putting these figures together means that providers spent a total £5,381m on temporary staff – overspending their budget by £883m.

There was also an overspend on substantive staff budgets of some £602m bringing the total overspend on staff costs to £1,485m (2.9%) on a planned budget of £50,817m. NHS Improvement described the planned staff spending as optimistic. Pay costs rose by 3.3% compared with the previous year, which after taking account of 2.1% pay inflation represented real-terms growth of just 1.2%.

Most of the overspending took place in the acute sector and was attributable to intense operational pressure. And even with the overspend, overall temporary staff costs decreased by £67m (1.2%) compared with 2016/17.

The temporary staff costs are driven both by demand being higher than the levels

planned for, but also by significant levels of vacancies. NHS Improvement’s Q4 report said there were 100,000 vacancies on top to the 1.1 million whole-time equivalent staff employed by trusts in England.

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.