News analysis - pulling both ways

The provider sector financial deficit deepened in the third quarter of 2018/19 as trusts struggled with familiar cost and income pressures, such as staffing, pay, contracting difficulties and emergency activity displacing elective income.

Providers reported an aggregate year-to-date deficit of £1,247m – £261m worse than plan, but £34m better than at the same point in 2017/18. At year-end, the sector is planning for a £394m deficit, but at Q3 it forecast it will spend £267m more than this – a deterioration of £148m since Q2 in spending compared with plan.

There are two points to note about the year-to-date and outturn financial positions. First, the year-to-date position would have been much worse had it not been for the consequences – in accounting terms – of the collapse of Carillion. The deterioration in the forecast financial position at Q3 compared with Q2 would have been £404m, not £148m. However, the forecast outturn benefits from an exceptional adjustment of £256m for part-donated assets – new private finance initiative hospitals at Sandwell and West Birmingham Hospital NHS Trust (£149m) and the Royal Liverpool and Broadgreen University Hospitals NHS Trust (£107m) that were brought onto providers’ books.

Second, NHS Improvement has further reduced the planned year-end deficit. At Q1, it targeted an aggregate year-end deficit of £519m, but warned that action would be taken to reduce the planned figure. A financial reset was launched in Q2, targeting incentive payments under the provider sustainability fund (PSF) to cut the planned year-end deficit to £439m. It has now reduced further to £394m.

So far, the planned deficit has been reduced by £125m compared with the original figure – at the time of the reset, NHS Improvement targeted a provider contribution of £254m to reduce the original £519m plan. Together with a £265m commissioner contribution, it hoped to get the system back in balance.

But with trusts missing their control totals and A&E performance still struggling in the face of huge demand, there will be increased amounts of unallocated PSF at year-end. This could be giving NHS Improvement the confidence to reduce the planned deficit. It is expected that, as with last year, remaining PSF – after funds have been allocated to trusts for achieving control totals – will be allocated to trusts, though the basis for the distribution is not yet clear.

Under the PSF incentives initiative, NHS Improvement has offered providers additional bonus payments to improve their financial position. It said 42 providers had signed up and most are forecasting they will achieve this improvement by year end. It appears that during a short window before the publication of the Q2 report, trusts were offered £2 of bonus PSF for every £1 improvement in their position signed up to – subsequently the offer has been £1 for every £1 improvement.

Against the lower planned deficit (£394m), providers are forecasting they will overspend by £267m, giving a forecast position of a £661m deficit – £142m more than the initial plan.

Some 52% of the 230 trusts are forecasting year-end deficits – nine more than at Q2. Again, most of the trusts forecasting deficits were in the acute sector (95 – 87 in Q2). Among ambulance and community trusts, four providers forecast deficits, while in mental health and specialist trusts, there were 11 and six, respectively.

Excluding PSF, 73 trusts forecast they would be off plan by year-end (37 more than at Q2). But when PSF was included, the number forecasting they would be off plan rose to 106 (23 more than at Q2). Some 38 providers said they would be off plan by more than £10m at year-end, after the inclusion of PSF.

Trusts said pay, principally Agenda for Change (AFC) salary rises, is one of the biggest reasons for the overspend against plan (see box). Income during Q3 was 1.5% (£937m) above plan, much of it due to the central funding of AFC awards.

Winter pressures were again evident in the profile of trust income. More non-elective income than planned was recovered by trusts – £362m or 3.3% above plan, while A&E income was 3% (£53m) and high-cost drugs income 11.3% (£373m) above plan. This was offset by lower-than-planned income from elective care (£162m or 2.2%). NHS Improvement said profit-making elective care was being ‘crowded out’ by loss-making non-elective care and zero-margin pass-through drug costs.

NHS Improvement chief executive Ian Dalton said the service treated record numbers of emergency patients during the early winter. ‘The NHS focus on treating the high numbers of patients across urgent and emergency services was one of the key reasons why the provider sector as a whole reported a year-to-date deficit of £1.2bn,’ he added.This is £261m more than planned but £34m better than the same period last year.

‘We continue to work with the trusts that are in deficit to achieve their plans,’ said Mr Dalton. ‘The NHS long-term plan will help trusts eradicate their deficits by 2023 by providing more support to acute hospitals where most of the deficit is concentrated.’

However, King’s Fund chief analyst Siva Anandaciva said the Q3 figures told a familiar tale of rising costs in the face of demand pressures. The revised planned deficit looked optimistic, but the trusts willing to stretch further and improve their bottom line could be the reason for NHS Improvement’s optimism.

‘It might make a difference to the reported position and it’s a way of moving cash out of NHS Improvement and onto the balance sheets of providers. But it plays into the narrative that trusts just need to try harder to achieve financial balance. Those that make it are rewarded and those that don’t miss out. This leads to greater variability in financial performance.’

Despite the difficult conditions, trusts continued to generate efficiency savings, though the amount delivered by Q3 was less than planned. The planned cost improvement programme (CIP) by this stage of the year was just over £2.3bn (3.5%), but the actual amount delivered was £244m less. Achievement of CIPs was affected by operational pressures and high vacancy levels, NHS Improvement said, though it added that CIP delivery tended to strengthen in the second half of the year.

As in recent years, trusts under-performed against planned recurrent savings – providers planned recurrent CIPs of just over £2bn, but achieved £1.49bn. However, non-recurrent schemes overperformed against plan, delivering savings of £602m – the planned level of non-recurrent savings was £279m.

Efficiency savings delivery tends to rise in the second half of the year, but with Q4 figures also including the impact of the bulk of winter pressures, it is difficult to see a major improvement in the financial position.

AFC deal impact

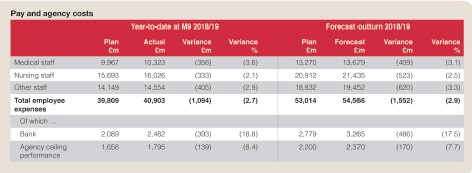

The sector reported a £1.1bn negative variance against planned pay spending in the year-to-date. NHS Improvement said a large proportion of this was due to Agenda for Change (AFC) pay costs. These were not included in plans at the start of the financial year and were introduced from quarter two.

AFC accounted for around £620m of the pay overspend on a year-to-date basis – by year end the overall overspend on pay is forecast to be £1.55bn, of which AFC will be £833m.

The government has pledged to cover the cost of the awards in full and has provided an estimated £780m for the full year. Potential further funding to make up the gap is subject to an application to the Department of Health and Social Care that was due to be completed in the final quarter of 2018/19.

Leaving aside the overall picture on funding for the pay award, individual trusts are feeling under-compensated for the increases in their pay bill. The Q3 report notes: ‘Providers say AFC is causing cost pressures, and this is having a serious consequence for a small number of providers as it has impeded their ability to achieve their PSF funding.’

Non-AFC factors account for £474m in the year-to-date overspend against plan, rising to a forecast £719m by year-end.

Temporary staff costs were a key driver in non-AFC-related spending as trusts used these workers to manage rising unplanned demand. Bank staff overspending was £393m above plan and agency £139m over the ceiling set by NHS Improvement. At year-end, overspending against plan in these areas is expected to rise to £486m and £170m, respectively.

NHS Improvement said bank and agency spending was £316m (8%) up on the same period in 2017/18, but the increase was due to more temporary staff employed rather than price rises – the average price per shift was 6% lower than for the same period in 2017/18. But NHS Improvement warned that agency costs could rise in Q4 and the yearend outturn (currently forecast at £2.37bn) could be between £2.4bn and £2.5bn.

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.