Increased spending limit reduces capital concerns, but better forecasting needed

Capital funding may have taken a back seat in recent years with an all-consuming focus on limiting providers’ revenue deficit. But it moved firmly back to centre stage, dominating discussions in finance circles in the early summer. Julian Kelly gave up a good proportion of his first major speech to the profession since becoming chief financial officer at NHS England and NHS Improvement to it.

There was a specific problem this year. NHS providers’ initial plans for spending on capital for 2019/20 would have breached the Department of Health and Social Care’s capital departmental expenditure limit (CDEL).

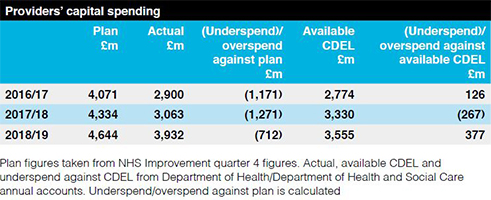

In fact, this is not that unusual. Take 2018/19 – providers started the year planning to spend £4.64bn, despite just £3.46bn of capital being available in their initial allocation from CDEL. They ended the year with actual spend of £3.93bn – an underspend of £712m compared with plan, but still nearly £400m over their final allocation.

The DHSC accounts – published in July – confirmed this overspend against CDEL by providers was compensated for by underspends in central capital budgets, giving an underspend against the overall CDEL of £42m.

Providers also overspent their CDEL allocation in 2016/17 (see table).

It is curious that in 2018/19, providers set off the year planning to spend £1.2bn or 35% more than was available – but triggered no central crackdown. The DHSC has traditionally been able to rely on providers significantly underspending against their capital plans – by more than £1bn in 2016/17 and 2017/18 and by more than £700m in 2018/19.

But 2019/20 was seen as providing something of a perfect storm, meaning that actual spending would get a lot closer to planned levels. Limited capital (CDEL) for the service overall; a growing need for capital projects to address backlog maintenance and underpin new models of care; and crucially, in some organisations, the cash available to fund these schemes.

This cash has been built up thanks to the Provider Sustainability Fund, which has rewarded trusts that were able to improve their financial position compared to control totals. In many cases, this revenue belt-tightening was sold to clinicians with an explicit promise that it would enable capital investment this year.

Calls on the service by Mr Kelly’s department to voluntarily reduce these capital plans – by a reported 20% – did not appear to be delivering the required reduction. It was looking as though cuts and capital control totals might be imposed.

But the increased capital funding announced by Boris Johnson as part of the new prime minister’s spending spree in August has now removed this specific tension. Of the £1.8bn cash injection, £850m is tied to specific projects, but £1bn is being used to enable increased capital spending this year – removing the need for the 20% cut in planned spending.

This led to an interesting debate on whether the £1bn actually represented new money. No, said the respected Nuffield Trust, arguing that providers were merely being allowed to spend their own savings. Yes, insisted the government, pointing to a real increase in the departmental spending limit.

It is easy to see both sides. The cash will indeed, at least in part, come from trust reserves. But is this really smoke and mirrors? This is the case every year. The CDEL sets the limit for all capital spending, irrespective of whether it is financed by public dividend capital, a loan from the Department or internally generated funds including depreciation charges and previously made surpluses.

But back to the issue of planned capital spending and limits. The real difficulty for the Department is knowing how actual capital spending will turn out. Hoping previous years’ underspending against plan will materialise again is being judged as too risky and Mr Kelly wants to see capital forecasting improve.

In an August letter, providing details of the increased spending limit, he called for the NHS to ‘collectively improve our forecasts and provide a taut and realistic view of the forecast outturn for your organisations in September’.

More specifically, Mr Kelly previously told the HFMA summer conference that he wanted trusts’ mid-year forecasts to be within 1% of their outturn spend.

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.