Feature / Heads up

The NHS finance function in England has remained relatively stable over the past two years. With the service facing significant financial challenges in this period, the latest headcount of NHS finance staff shows only minimal increases in staff numbers.

The NHS finance function in England has remained relatively stable over the past two years. With the service facing significant financial challenges in this period, the latest headcount of NHS finance staff shows only minimal increases in staff numbers.

This has been accompanied by small changes in the balance of services delivered by finance teams – with rising numbers of staff identified as ‘financial management’ at the expense of reductions in the numbers of financial accountants and staff working in services such as payroll and audit. The function is also increasingly qualified.

But, with nearly two-thirds of the function made up of women, there remains an imbalance in the number of women reaching the most senior roles – just over one in four finance directors are women.

The HFMA and Finance Skills Development have been collaborating since 2009 to develop a biennial census of the English finance function (the HFMA is undertaking similar exercises for the first time in Northern Ireland, Scotland and Wales this year with results due to be published later in 2016). A new briefing from the two organisations sets out the results of their fourth formal census based on the finance staff in post at the end of June 2015. The HFMA has published the findings of its latest staff attitudes survey alongside the census (see page14).

The census covers 529 organisations, including 488 ‘core’ NHS bodies. These core bodies cover providers, clinical commissioning groups, the various tiers of NHS England – counting the specialised commissioning hubs as separate organisations – and commissioning support units. The wider definition of organisations includes ‘non-core’ bodies such as the NHS Trust Development Authority, Health Education England and, for the first time, the Department of Health as well as a small number of shared service and audit providers and some social enterprises.

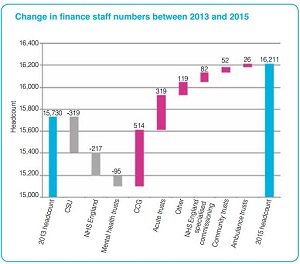

The census figures show a total finance function headcount of 16,211, suggesting a 3% increase or an extra 481 staff compared with the 2013 figure of 15,730. Adjusting these figures for a more like-for-like comparison – stripping out the 173 Department finance staff not included in the 2013 census – and the total falls to 16,038, an increase of just 2%.

This same increase – 2% – can be seen within the core NHS, where the NHS finance family has grown by 362 staff to 15,403.

There have been bigger increases in finance staff numbers in London (9%). However, some of this can be attributed to changes in how NHS England has reported staff numbers by region – the figure across non-NHS England core bodies is still high at 6%. Staff numbers have stayed static in the south.

Analysing the headcount figures by organisational type sho ws significant reductions in finance staff at CSUs (30%) and at NHS England (21% including specialised commissioning). These reductions reflect the consolidation of CSUs and the 2015 restructuring of NHS England into four regional tiers and the effective reduction of area teams. These are balanced and then outweighed by increases in commissioning organisations and providers.However, there are differences between provider types. For example, a net increase of 302 finance staff across all provider types masks a reduction in staff at mental health providers. It is not clear why. Closer examination of the figures reveals there have been big percentage swings in both directions within mental health trusts.

ws significant reductions in finance staff at CSUs (30%) and at NHS England (21% including specialised commissioning). These reductions reflect the consolidation of CSUs and the 2015 restructuring of NHS England into four regional tiers and the effective reduction of area teams. These are balanced and then outweighed by increases in commissioning organisations and providers.However, there are differences between provider types. For example, a net increase of 302 finance staff across all provider types masks a reduction in staff at mental health providers. It is not clear why. Closer examination of the figures reveals there have been big percentage swings in both directions within mental health trusts.

The overall reductions in mental health equate to an average reduction of two staff per provider from 2013’s average of 41 staff. In mental health NHS trusts specifically, average staffing levels dropped by five. These contrast with increases of four and five respectively in the average staffing levels for foundation trust and NHS trust acute organisations.

Finance team size will depend on a number of factors, including whether any services are outsourced or if services are provided in-house for other NHS bodies. Some trusts provide payroll, for example, to more than 10 other local bodies. But there is a clear link in finance team size and the overall size of the organisation, measured in turnover.

Team size rises from an average of 21 staff for acute trusts with under £100m turnover up to more than 100 staff on average in the biggest providers turning over more than £500m. There are no mental health trusts with a turnover of more than £500m, so average team sizes do not stretch so high, but the core trend is similar.

There is little difference in staffing levels in acute and mental health when comparing organisations of similar size. For example the average team size in the 28 acute trusts between £100m and £200m is 32, while the comparable figure is 34 in the same number of similarly sized mental health organisations.

In commissioning, the trend has been for staff increases at the local level offset by reductions at the centre. Across NHS England’s various levels, there has been a 21% reduction in finance staff with just under 500 staff now serving national, regional, sub-regional and specialised commissioning teams. A 30% reduction in headcount at commissioning support units reflects 11 fewer units compared with 2013.

In headcount terms, CCGs added more than 514 staff (475 whole-time equivalents) to their finance teams, adding more than two staff to the average CCG staffing level. However, a quarter of the increases can be attributed to four CCGs, with the increases likely to reflect changes in local commissioning support.

Big increases in London CCG average staffing levels – in part due to changes in commissioning support arrangements – have to be seen alongside lower average staffing levels per billion of turnover, compared with CCGs in the other three regions.

Levels of seniority

The collaboration between HFMA and FSD provides a view of the NHS finance function broken down by seniority (by Agenda for Change pay band) and function. There are 476 director level finance staff across the 529 bodies in the census – the difference reflecting shared director arrangements and vacancies.

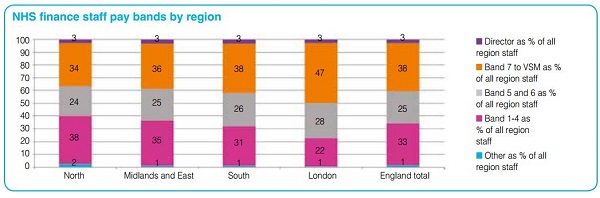

Nearly 6,100 staff working at band 7 or above represent 38% of the whole function, with a further quarter operating at band 5 or 6. Staff at band 4 or below make up 34% of the complete finance team. This represents a slight fall in absolute numbers and percentage terms at bands 1-4 and a corresponding increase at band 7 and above. This may reflect further moves to outsource transactional services to organisations not included in the census and also suggests the increase in staff has come at the senior end of the finance function.

There continues to be a higher proportion of more senior staff in London organisations – not including directors, 47% of staff on average are at band 7 or above, compared with, for example, 34% in the north.

Analysing bandings by organisational type shows CCG finance teams have a higher proportion of senior staff (52% band 7 and above compared with 34% in providers). CCGs’ mandatory use of the integrated single financial environment provided by NHS Shared Business Services for core finance and accountancy services will be a key contributor to this difference.

There have also been some changes in the activities undertaken by finance teams. The census identifies three broad roles for finance staff. Financial management covers financial planning, management accounts, performance, commissioning, costing and contracting. Financial accounting covers accounts payable and receivable and treasury. And financial services includes audit, payroll, financial systems and projects.

The majority of the function are in financial management roles (53%) – a slight increase on the 50% in the 2013 census. This increase is delivered by small decreases in the proportion of staff working in financial accounting (27% down from 29%) and financial services (18% down from 19%). The remainder operate in administrative or secretarial roles.

The function remains highly qualified, with a majority having a specific finance qualification (or working towards one). Nearly one in three (31%) has a CCAB or equivalent qualification with a further 13% studying to join them. A further 12% have or are working towards accounting technician qualifications. There is a good argument for suggesting the function is continuing a trend towards greater qualification. This possibly reflects moves towards a more strategic and less transactional role and also the increasing use of shared services, which may see transactional staff move outside of the NHS.

The 7,111 CCAB or equivalent qualifieds or students represent a large absolute increase of 379 staff since 2013 and 551 since 2011, although stripping out the Department of Health staff (newly added to the census), these increases fall to 310 and 482 on a like-for-like basis. Looking just at the core NHS, the increase in qualified and student accountants (276) accounts for three quarters of the total finance staff increase (362). But as a percentage of the whole function, the function continues to move towards being more qualified (up to 44% from 43% in 2013 and 40% in 2011).

Of the 7,111 CCAB or equivalent body qualified or student staff, almost half (48%) are CIMA qualified or studying, while 33% are ACCA qualified or studying and 13% CIPFA.

The census also confirms that the NHS has made no progress in improving the number of women occupying the most senior finance roles. While women make up 62% of the NHS finance staff headcount, they only hold 26% of finance director roles – in fact a two percentage point fall on the 2013 figures.

In some more junior bands, women make up more than 75% of all staff and across all bands up to and including band 6, they represent 71% of staff. For bands 7 to very senior manager grades (not including directors), the split evens out. However within these more senior roles, they represent just 40% of band 8d and 35% of band 9s.

The HFMA has recently looked to gain a better understanding of any obstacles to achieving a better gender balance in finance director positions (see ‘Women leaders in health’, December 2015).

For the first time, the census undertook a voluntary collection of information about the ethnicity of the finance function. This shows that the function is predominantly white British, with 72% of the function identifying in this category (76% in the slightly broader ‘white’ category). However there are large regional variations. London, for example reported just 34% of staff as white British, although ethnicity details were not disclosed for a quarter of all finance staff in the capital. By comparison, the North reported 83% of finance staff as white British.

Some 9% of finance staff are Asian or Asian British and 4% are Black or Black British. For London the Asian and Black communities are larger at 19% and 12%.

The function largely mirrors the ethnic composition of the broader NHS workforce. NHS Employers figures for the whole NHS suggest that 78% of staff are White, 5% Black or Black British and 8% Asian or Asian British.

In reality the 2015 census might provide a baseline against which to compare the impact of changes to corporate and administrative services flowing from February’s Carter productivity report. Lord Carter has suggested trusts that have ‘not examined’ these functions ‘closely’ could save 8%-10% on current costs. He has also spotlighted the potential for greater use of shared services as providers look to meet a new corporate/administration workforce cost cap of 7% of income.

These changes could have a significant impact on how financial services are delivered across the whole service.

Behind the numbers

The HFMA/FSD census provides the numerical analysis of the finance function, but the HFMA’s attitudes survey asks finance staff how they feel about their jobs. Steve Brown reports

Finance staff typically spend long periods with the same organisation, often more than two years in a specific role. Overall they enjoy their careers. And while there are concerns that current pressures may have a negative impact on job satisfaction and a feeling that finance isn’t always valued as it should be, almost two-thirds would like to spend the rest of their careers in the NHS.

These are some of the findings of the HFMA’s second staff attitudes survey, published alongside the HFMA/FSD census.

The survey, open to qualified finance staff and those studying, drew a response from 526 staff in England – representing 7% of the 7,111 qualified and student body.

Half of the sample had worked for their current organisation for more than three years – with nearly one in four racking up more than 10 years with the same organisation. But turnover of roles was higher – half the sample had been in their current role for less than two years and fewer than 15% for more than five years.

Job satisfaction is skewed towards the positive end with a mean score of 6.7 out of 10 – the 2013 score was 6.8. Job satisfaction rises with seniority and is greater in the north (7.1) than in London (6.3). Where there is low satisfaction, respondents cited job pressures and increasing workloads as the key culprits. There were also concerns about a lack of development and promotion opportunities and organisation-specific issues such as poorly designed processes.

Nearly one in five think job satisfaction will worsen over the next year, though more (29%) think it will improve and half anticipate no change. Two-thirds of the sample would like to spend the rest of their careers in the NHS, but only 47% think this is likely. With one in six not expecting to complete their career in the NHS and nearly 40% not knowing, the HFMA acknowledges there is a degree of uncertainty and concern among finance staff about job security. In fact 45% of the sample were concerned about losing their job in the next few years and an additional 13% in the next year.

The NHS’s current financial pressures are reflected in the hours put in by finance staff. More than one in four said they ‘always’ worked in excess of contracted hours, and working excess hours ‘at least three times a week’ was the norm for a further 22%.

Three-quarters of the sample are happy with the career opportunities offered by NHS finance and 78% believe they have been given adequate development in their current role. Some said career progression would mean moving to a different organisation – not always easy for those with family commitments. Others suggested there was a mismatch between the good support provided to graduate and director-level staff and that offered to middle managers.

Nine out of 10 finance staff say their department provides value to their organisation. Comments suggested there were still opportunities to improve finance staff knowledge of the business and to improve finance systems. There were also concerns about the impact of staff turnover, vacancies and the use of interims.

Nearly 80% of staff said they felt valued by their line managers, but very few felt valued by the Department of Health, the public or patients – one in five said they were ‘not at all’ valued by these three groups. More than 70% – as in the 2013 survey – said they were driven by ‘public sector values’ to work in the NHS. Remuneration was only seen by one in five as a motivation, but there was more recognition of the pension benefits.

‘We’re going to rely heavily on finance directors and their teams to see the NHS through the current financial challenges so the key now is to keep the most skilled people in the service and keep them motivated,’ says Paul Briddock, HFMA policy and technical director. ‘We must be mindful of the immense pressure these people are under and make sure that the new initiatives, caps and rules being introduced in a bid to make savings and improve productivity aren’t being used as a stick to further beat them with. Rather, we need the entire health and social care system to work together collaboratively.’

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.