Technical / Department brings FTs back into fold with group accounting manual

The Department of Health issued the Group accounting manual 2016/17 (GAM) early in September, with only minor changes compared with the version it consulted on at the beginning of the summer.

The manual sets the accounting rules for all bodies within the Department’s group accounting boundary, which includes more than 450 bodies. For the first time, NHS trusts, foundation trusts and clinical commissioning groups will all refer to this manual for guidance – previously foundation trusts followed separate guidance issued by the (then) regulator Monitor.

There is one exception to the ‘one manual to rule them all’ approach – the second chapter on the requirements for the annual report. This is not applicable to foundation trusts, which will refer instead to an annual reporting manual that will be published by NHS Improvement later this year.

The manual covers all organisations in the Department group, but some guidance is specific to organisation types.

In its response to the consultation, the HFMA had suggested this was not always clear. The Department has taken this on board and made this much clearer in its final version, while also using consistent terminology to refer to the different types of NHS entities.

All the main changes (compared with the 2015/16 requirements) broadly remain as they were proposed in the consultation draft. Some of these aim to align reporting requirements for foundation trusts with the rest of the NHS. For example, the previous requirement for foundation trusts to make separate disclosures in relation to director benefits under s412 of the Companies Act 2006 has been removed.

The requirement to use the market discount rate when using future cashflows to calculate the fair value of financial instruments has also gone. Neither of these changes are likely to have a significant effect.

However, one change will have an impact on a small number of foundation trusts – the requirement that all NHS bodies use £5,000 as their de minimis limit for capitalising individual or grouped assets.

While this has previously been the case for NHS trusts and CCGs, foundation trusts have previously been allowed to apply a different de minimis. Some had set the threshold at up to £15,000. For those foundation trusts, this seemingly small change may require a lot of work to implement.

The HFMA had asked for confirmation of whether this should be treated as a change in estimation technique or accounting policy – the latter potentially requiring prior year restatements, which would be difficult for some bodies. However, the Department has not provided a definitive view. ‘Any foundation trusts for whom adoption of the [lower] threshold would be a change in accounting policy should consider whether the impact is sufficiently material to require prior year restatement in line with IAS 8,’ the manual says.

The HFMA has encouraged NHS foundation trusts in this position to have early discussions with auditors.For non-foundations, chapter 2 covering the annual report now provides clearer guidance on which bodies are required to produce which parts of the Parliamentary accountability and audit report.

A useful table summarises the parts of this report that are mandatory, not applicable or optional for each type of NHS entity.

Detailed information on staff numbers and detailed staff cost analysis – previously reported in the accounts – will now move to the annual report, with just a single column reported in the accounts.

Finally, chapter 2 now reflects the requirement (already included in Managing public money) to report the total value of gifts made if they total more than £300,000 and provide details of individual gifts over this amount.The two main changes that will have an impact on all entities are:

• Clarification about the valuation of loans from the Department – to be held as the historic cost of the principle outstanding, with any unpaid interest held as a separate accrual

• A reminder that in some circumstances it is appropriate to value PFI assets net of VAT.

This can only be done where the VAT is recoverable and the approach has been agreed with both valuers and external auditors.

Technical review

Difficulties producing the annual report and accounts for 2015/16 related to one-off events in what was otherwise a ‘business as usual’ year, according to an HFMA survey of finance practitioners. The survey, which drew 84 responses from commissioning, commissioning support and provider bodies, follows surveys of just the commissioning sector in the previous two years. Other than one-off events, such as mid-year mergers, the difficult issues tended to be dealing with new initiatives such as the better care fund and primary care co-commissioning. The financial pressure in the year led to additional auditor scrutiny, with a focus on prudence following communications from the centre. The agreement of balances exercise again consumed a lot of time and resource. Detailed feedback from the survey has been shared with the Department of Health, NHS Improvement, NHS England and the National Audit Office and the association will use the findings to inform its work programme and next year’s pre-accounts planning conferences.

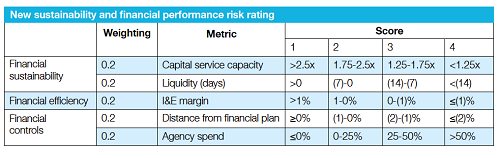

An agency spend metric has been added to the four finance metrics proposed by NHS Improvement for its finance and use of resources assessment as part of the new single oversight framework (see table below). The final framework was published in September following consultation over the summer (Healthcare Finance September 2016, p27). The consultation had proposed to operate the agency spend metric, which looks at distance from a provider’s cap, in shadow form for the rest of 2016/17. Two further metrics – change in cost per weighted activity unit and distance from capital control total – will stay in shadow operation as proposed. But the oversight body has removed the specific score thresholds set for these metrics while further work is done and the metrics are better understood. NHS Improvement has also decided to return to measuring income and expenditure margin rather than EBITDA margin. It had proposed switching to the earnings margin as part of its consultation. All five metrics will have equal weighting in the overall finance rating. There has also been a change in the language used, describing the framework in terms of providing support rather than identifying concern.

A busy work programme for the HFMA will see it continuing to support the transformation agenda with reports on sustainability and transformation plans and what the NHS can learn about integration from across the UK. The programme, approved by trustees over the summer, sets out plans for briefings, guides and other outputs in five policy areas:

• Transforming service provision

• Building a sustainable financial future

• Knowing the business

• Getting the basics right

• Giving a national perspective.

The association will continue to take financial soundings from directors with its biannual NHS financial temperature check. It aims to supplement this with an examination of the NHS finance function following Lord Carter’s work on productivity and it will explore the impact on the NHS of the vote to leave the European Union.

At a more detailed level, there will be briefings that look at accounting for joint working and maintaining good governance in challenging times. The complete work programme can be found on the HFMA website

Nice update: learning disability guideline

NICE has produced a guideline (NG54) offering best practice advice on the prevention, assessment and management of mental health problems in people with learning disabilities in all settings, writes Nicola Bodey.

Mental health problems in people with learning disabilities are more common than in the general population, with a point prevalence of about 30%. They are also under-recognised in people with learning disabilities, and professionals are increasingly aware that mental or physical health problems can be incorrectly attributed to the person’s learning disabilities.

Recommendations include cognitive behavioural therapy, adapted for people with learning disability, to treat depression in people with milder and more severe learning disabilities and using graded exposure techniques to treat anxiety or phobias.

Experts suggest there is variation in services across England. Implementing the guideline may have a resource impact for the NHS and local authorities in several areas:

• Staffing

• Staff training

• Psychological interventions

• Annual health checks. Implementing the guideline may result in the following benefits and savings:

• Improved recognition of the symptoms and signs of mental health problems in people with learning disabilities, leading to effective treatment

• Prevention of mental health problems in people with learning disabilities, leading to reduced costs

• Reduction in the costs of treating mental health problems in people with learning disabilities

• Reduction in associated support and social care costs.

These mental health services are commissioned by clinical commissioning groups (CCGs) and NHS England. Providers are NHS hospital trusts, primary care services. Independent hospitals and secure care services (usually through specialist commissioning). Commissioners will need to work with providers of mental health services to ensure that local services for people with learning disabilities follow the recommendations.

Nicola Bodey, NICE senior business analyst

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.