Technical / Consultation sets out plans for new, broader use of resources assessment

This ‘new’ use of resources assessment would again be undertaken by NHS Improvement and used to inform its oversight of trusts. But it would also be submitted to the Care Quality Commission for consideration and then published as part of the CQC’s overall reporting and rating of provider performance. Under current plans, it would appear as a separate rating alongside the familiar quality ratings.

To be fair, although the new consultation is hot on the heels of the recently published finance assessment and single oversight framework, the new assessment’s development has been well trailed – with the health secretary first asking the CQC to add resources to its inspection checklist in early summer 2015.

Subject to joint consultation by the CQC and NHS Improvement, it will in any case build on the single oversight framework assessment, rather than completely replace the metrics.

A quick recap on the single oversight framework (SOF) is probably helpful. It identifies providers’ support needs using triggers and metrics in five themes – the pertinent one in this context being finance and use of resources. This includes five financial metrics: capital service capacity; liquidity; I&E margin; distance from financial plan; and agency spend. Further metrics (cost and capital) were already under consideration for 2017/18.

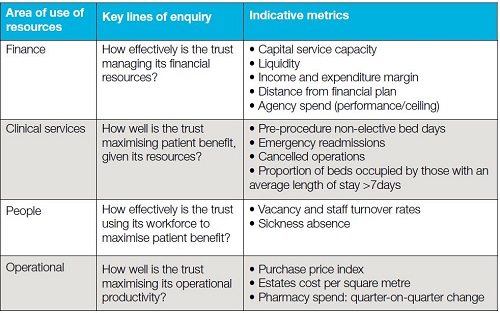

The use of resources assessment expands the definition of resources beyond simple financial performance. In this context, resources now refer to four areas: finance; clinical services; people; and operational productivity.

The finance metrics in the SOF would continue to support the pure finance assessment within use of resources. But several metrics are being considered in the other areas: emergency readmissions (clinical), vacancy rates (people) and estates costs (operational), for example.

The proposed metrics are ‘for illustrative purposes’ and ‘not the final shortlist’. And context will be used alongside the metrics – local intelligence and locally used metrics and other additional data from the oversight body’s model hospital programme. In keeping with the CQC approach, the broader use of resources assessment will assign trusts to one of four categories: outstanding; good; requires improvement; inadequate.

The consultation says it is important to distinguish between a trust’s finance and use of resources score (measured monthly in the SOF), its SOF segmentation and its annual use of resources assessment rating.

Providers will continue to receive a monthly finance and use of resources score – based on the five metrics – and this will contribute to the decision on segmentation, triggering different levels of provider support.

However, when the trust has a broader use of resources assessment, which will coincide with a broadly annual inspection by the CQC, this new resources assessment will be used as the finance and use of resources score for that month (with good translating to a 1 score and inadequate to a 4). This will remain in place until NHS Improvement is satisfied improvements have been made, indicated by continuing monthly assessment using the five metrics and by the achievement of milestones set out in any improvement action plan.

Finance managers told Healthcare Finance the language – with finance and use of resources referring to separate but related assessments – was confusing. But they have until the middle of February to let the oversight bodies know what they think in detail.

Technical review

All the key financial guidance documents covering reporting and accounting in the NHS were published during December and January. The Treasury’s Financial reporting manual introduced a new requirement to include a summary in the overview section of the annual report and more detailed integrated performance analysis. It also introduced a change to the definition of salary and allowances to include any severance payments for loss of office. These were formerly disclosed separately but not included in the remuneration table. The Department of Health’s Group accounting manual 2016/17 was also published in December. A series of eight frequently asked questions (FAQs), included in additional guidance, describe the latest amendments and this will be updated as additional FAQs arise through the year – keeping all additional guidance in a single document. The package of guidance was completed in January with the release by NHS Improvement of the Foundation trust annual reporting manual.

All appointments to posts defined as ‘office holders’ should be on payroll, regardless of the expected duration of the appointment, according to new guidance from NHS Improvement. This means that PAYE should be deducted at source and office holders not engaged using a personal services company, an employment agency, consultancy or other intermediary vehicle. Earlier guidance had allowed accountable officers to sign off on exceptional temporary circumstances and capped the duration at six months, but now this can only happen where the off-payroll engagement is to cover an office holder who is temporarily unable to perform duties. Existing office holders should move from off-payroll to on-payroll engagements, or be replaced by alternative on-payroll candidates, at the end of their engagement or by 30 April 2017.

The proposal to introduce an administration levy for the NHS Pension Scheme will add a further cost pressure that has not been included in the 2017/19 two-year tariff, according to the HFMA. Responding to the Department of Health consultation on the planned measure (which closed in January), the association noted the reasoning for the proposed change – the Department believes it will increase employer engagement and opportunities for innovation. However, the HFMA said its members also believed the proposal would shift costs from the Department to the wider NHS, including GP practices. These costs would come alongside costs levied by the Care Quality Commission and NHS Litigation Authority, as well as changes to the tax regime relating to salary sacrifice and off-payroll arrangements.

At the end of 2016, NHS Improvement set out the provisional timetable for the submission of costing data for 2016/17.Timescales depend on whether a provider has signed up to be an early implementer of patient-level costing. Acute early implementers will have to submit patient-cost data, as part of the Costing Transformation Programme (CTP), by the end of July, with reference costs submission (including and net of education and training) due by the middle of September. Mental health and ambulance road map partners will face a September submission deadline for both patient-level and reference cost data (despite earlier indications of a July deadline for the patient data). All other providers face an earlier – end of July – deadline for both their reference costs submissions. The differential deadlines aim to help early implementers to make progress on patient costing as part of an accelerated CTP (see Healthcare Finance, December 2016).

Nice update: Improving antimicrobial stewardship

Antimicrobial stewardship refers to an organisational or healthcare system-wide approach to promoting and monitoring judicious use of antimicrobials to preserve their future effectiveness. Services are commissioned by local authorities and clinical commissioning groups (CCGs). Providers are prescribers, primary care and community pharmacy teams, and childcare and education providers.

New NICE guideline NG63 offers best practice advice on antimicrobial stewardship and aims to reduce inappropriate antimicrobial demand and use, and prevent infection. It covers making people aware of how to use antimicrobial medicines (including antibiotics) and the dangers associated with their overuse and misuse.

It also includes measures to prevent and control infection that can stop people needing antimicrobials or spreading infection to others.

Implementing the guideline is anticipated to be a cost saving overall because of:

- Reduced prescribing of antimicrobials

- Reduced treatment costs as a result of fewer infections that are resistant to antimicrobials and fewer infections resistant to multiple drugs

- Fewer infections requiring hospital admission.

Savings for England cannot be accurately quantified, but are likely to be significant.

For example, a reduction in adverse events associated with use of antimicrobials such as clostridium difficile infection (CDI) may save the NHS around £10,000 per case. Each non-elective admission for gastroenteritis costs the NHS between £760 and £8,240, and a non-elective admission for respiratory infection costs between £960 and £5,570.

Preventing 1% of non-elective hospital admissions for these two common infections could save around £2.8m a year in England.

Implementing NICE’s guideline may result in additional costs in the short term by:

- Introducing approaches to reducing inappropriate antimicrobial demand and use (for example, providing resources on self-limiting infections)

- Introducing approaches to prevent and limit the spread of infection (for example, providing information on hand washing)

- Producing written information for prescribers, primary care and community pharmacy teams to share.

Nicola Bodey, senior business analyst, NICE

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.