Feature / Combined forces

NHS Improvement wants trusts to consolidate their back-office services, including much of the finance function, as part of the STP process. But what can be achieved and will it be chearper? Reports Seamus Ward

Shared services are not a new idea in the private sector or in the NHS. There are significant NHS shared services operations in Scotland, Wales and Northern Ireland, while clinical commissioning groups in England have used shared services from their inception through commissioning support units and the NHS Shared Business Services-run integrated single financial environment.

In English provider trusts, the movement towards shared services has been much more glacial, but it was given a push this summer by NHS Improvement. Keen to help providers tackle their aggregate deficit, the watchdog wrote to the 44 sustainability and transformation plan (STP) areas in August, asking them to review and consolidate back-office services. Priority areas were finance, HR, IM&T, procurement, payroll, governance and risk, estates and facilities and legal services.

The finance function included seven areas for review – financial accounts, management accounts, accounts payable, accounts receivable, income planning, commercial teams and internal audit.

The letter raised eyebrows in the finance community – management accounts, income planning and commercial teams are generally not deemed ripe for outside provision. Healthcare Finance spoke to a number of finance directors who were incredulous about the inclusion of these functions.

Although this may have ruffled a few feathers, some believe there is no option but to share or outsource most of the seven financial services listed. Others are more relaxed, believing they must review – or be seen to be reviewing – provision

without necessarily changing who provides the services.

Patchy performance

NHS Improvement’s John Warrington (right)

acknowledges that the approach from STPs

so far has been somewhat of a mixed bag.

‘Some are looking at it well, some have already done it and done it well, and in others it is not even on their radar,' he says. 'We are committed to helping and supporting STPs to look at this area and put together more robust plans by the end of October so we can embed the plans in the next iteration of STPs in November.’

He adds that trusts should be aware that the push for back-office consolidation is coming right from the top of NHS Improvement. ‘Jim Mackey’s view is that they should be getting on with it. STPs have a lot of priorities and the back-office consolidation could drop of the scale, but he is adamant this needs to be done.’

Mr Warrington insists opportunities exist to make savings in the back office through consolidation. For example, only 60% of trust payroll and 35% of their accounts payable has been consolidated.

NHS Improvement takes the view that while trusts cannot control some costs – demand for clinical services, for example – they can bear down on back-office spending. It is also looking at how much consolidation can save, asking trusts for information on back-office service costs to see if savings are reflected in the costs of NHS organisations that have consolidated.

Healthcare Finance conducted a small survey of trusts’ attitudes to the move to consolidate financial services (see box below). Although the snap survey attracted only 33 respondents, it gives some insight into how STPs are approaching back-office consolidation.

Finance managers are almost evenly split over whether sharing or outsourcing financial services can deliver the same or better quality as in-house providers (47% think they can, 53% said no).

However, a clear majority (61%) said sharing or outsourcing would deliver savings compared with in-house provision.

In comments, finance managers said the payback could take two to three years and business cases had to be realistic. Where they could be provided at scale, sharing transactional services made economic sense, they said. Others said the savings would be marginal as there were costs in managing any external solution and in making redundancies.

While 18% of respondents said costs would increase and 15% said they would stay the same, more than 42% said the savings would be less than 5% of current costs. A further 18% believed savings would be between 5% and 10% of current costs, while 15% thought savings would be greater than 10%. This included one respondent who said savings would be more than 20%.

Survey respondents were almost equally divided on the timing of the NHS Improvement move to consolidation, with 52% saying it was not the right time. Typically, these respondents believed trusts needed a stable finance team in the face of the other challenges, including Carter and transformation.

Consolidation would prove to be a major distraction. However, the opposing view was that the financial squeeze made consolidation unavoidable. Others felt the organisational reconfiguration that could take effect under the STPs made sharing back-office services a natural next step. But, as Mr Warrington says: ‘When is the right time? We believe there is £350m on the table [across all back-office services] – we need to get on with it.’

STP support

NHS Improvement emphasises that trusts are not alone and it will provide support. At the moment, only a small amount of Mr Warrington’s time is spent on back-office consolidation, but NHS Improvement plans to build a team to support STPs.

He says NHS Improvement’s approach is based on the Carter methods – generate information, produce benchmarks and identify good practice. Recently, it has commissioned PA Consulting to help begin the work in earnest. ‘Its job is primarily to look at STP plans, identify good practice and benchmarks to help and support the development of these plans and to challenge them where necessary.’

The consultants will also look at the supplier side of the market. But what capacity is there in the market?

Jordon Beevers, NHS Shared Business Services (NHS SBS) development director for STPs, detects a renewed determination among NHS leaders to push it forward.

‘With the introduction of STPs, we feel NHS SBS can contribute towards making this happen. With the emergence of STPs, NHS SBS has a strong and reliable offering to support trusts with back-office consolidation while delivering benefits and efficiencies,’ he says.

There have been a variety of responses to the NHS Improvement initiative, with about 10 STPs proactively approaching SBS ‘to see how we can support and develop their plans’, says Mr Beevers.

‘We are contacting each of the 44 STP senior responsible officers and finance leads to understand their current thinking and provide additional support to help them develop the plans to submit by the end of October. We are engaged with about a quarter of STPs but we have an ambition to engage with all of them.’

He believes NHS SBS could provide a ‘good proportion’ of the areas listed for review by NHS Improvement, not just in finance. The joint venture has experience in implementing and running a large cross-boundary NHS financial shared service, he says. An example is the integrated single financial environment now used by all clinical commissioning groups.

Mr Beevers adds: ‘We will be led by our customers and are supportive of reaching into areas that haven’t traditionally been associated with the NHS SBS portfolio of services.

‘We have our own future services programme that is working to improve and enhance services that will support STPs over the next five years. We will do this in partnership with our clients to meet their future service needs.’

Many NHS organisations already share financial services within the health service, with some large trusts providing payroll and other transactional services to neighbours. And a number of consortia, initially established to serve a local area, have become national concerns.

Joined up working

Originally established in the North East of England, NEP Shared System Group (formerly North East Patches) provides a single, Oracle-based system for finance and procurement. It is an NHS consortium hosted by Northumbria Healthcare NHS Foundation Trust and serves 38 NHS organisations across the North East, North West, South West and London.

Christine Hall (right), associate programme director

for the consortium, says most of its members operate financial services in-house using the single system. However, the host trust provides transactional processing for two NEP members.

‘This works quite well as it reduces the need for software licences and, with the same data sets, it does help drive through best practice in its processes. Other members of our consortium are looking at how we can expand this offering, which will bring in additional savings locally,’ she says.

‘In other geographical areas, there are opportunities to work collaboratively with other service providers who offer the same software solution. Discussions are taking place to see how we can support this.’

Ms Hall adds that, working with its host trust, it can support all the financial services listed by NHS Improvement for review, in terms of both providing services and systems needed. ‘NEP is in a strong position and has the ability to share services with other NHS bodies, purely because we are offering a single platform and single data set.

‘We accept it becomes increasingly difficult to offer shared services when NHS organisations are using stand-alone, disparate systems that don’t have any standard approach. However, the NEP solution is flexible enough to support the needs of individual organisations’ requirements, either through a shared system or shared service option.’

NEP is committed to further enhancing its ability to support back-office services, adds Ms Hall. It has recently added e-invoicing, budgeting and forecasting to its services.

‘In addition, we have partners who, again through the use of technology, can help to minimise the effort from our client organisations to streamline their processes at a minimum cost,’ she says.

ELFS is an NHS-hosted, shared services provider that has 30 health service clients for its finance and payroll services. Managing director Graham Gornall says: ‘When shared services are delivered well, the provider can be a major asset to an NHS organisation, offering a high-quality and efficient operating solution.’

ELFS has more than 14 years’ experience in the NHS, he says, and has grown steadily over that period providing a personal service that has seen it attract net promoter scores that are upper quartile for the shared service sector.

To date, ELFS has agreed with its clients that management accounts, budgetary control and business decision support are best managed locally, though Mr Gornall adds: ‘Things could be different in the future if clients want to take shared services to another level.’

Scaling issues

He believes the big challenge in the short term is scaling up the shared service sector quickly. ‘Growing the shared service sector will require investment in technology and capacity,’ he says, ‘which potentially needs to be ready to be able to take on multiple organisations at the same time.’

Some areas of the finance function traditionally seen as sacrosanct in-house services, such as management accounting, were included in NHS Improvement’s list of services for review.

Mr Warrington admits there was some debate about whether to include management accounting, given its importance in supporting frontline staff to deliver efficient services, for example. But he adds: ‘Looking around the world, we knew that we could probably do better in terms of quality and efficiency. It should be looked at, though it might be that it comes a little later. We'll have a better view by the end of October and will look at it carefully.’

The Healthcare Finance survey shows little appetite to share or outsource management accounts, income planning and commercial teams. All trusts currently provide these services in-house and only two say they plan to share management accounts with other NHS bodies. Three expect to move income planning and commercial teams to a shared NHS provider, but none of them plan to outsource these services to a non-NHS provider.

‘Income planning, management accounts and commercial teams do not lend themselves to outsourcing,’ one finance director says.

Even where change is anticipated, it’s striking how few trusts are expecting to outsource financial services to non-NHS providers, even in well-established transactional areas such as accounts payable/receivable and payroll.

One finance manager said: ‘We've explored using shared services on a number of occasions but in-house remains a less expensive option.’

However, private sector provision has not been ruled out altogether. ‘We are currently reviewing the transactional processing elements – initially we would look to share back office with other NHS organisations but if the most efficient way of providing this going forward is non-NHS, that would be explored,’ one finance director commented.

Finance managers believe prohibitive start-up costs are a major risk in the move to shared services. One finance director told Healthcare Finance that local trusts had been talking about buying a new finance system but payback would take many years. ‘We have been consulting on moving to one ledger but the barrier is the cost of the IT. If there was IT transformation money earmarked for back-office consolidation, we would probably do it.’

Mr Warrington acknowledges start-up costs would have to be taken into account when putting together a business case. But NHS Improvement is keen to build on existing shared services, using their infrastructure to minimise start-up costs. ‘We already have solutions in place and it makes sense to use these to avoid start-up costs. There are questions about whether they are fit for purpose and we need to look at that.’

Technology input

NHS SBS provides the tech as part of its service. ‘We make the investment on behalf of our clients, but in-house services will have that consideration [start-up costs] to make, Mr Beevers says. 'There is a significant push from the centre to ensure there is lower spending in capital and back office because of the requirement to invest further in clinical services. It is an opportunity for NHS SBS to work with STPs to put plans in place, but also to draw out a road map across the next five years for continuous improvement in technological quality and efficiency.'

NEP’s Christine Hall says her consortium is a not-for-profit organisation, with costs shared across the consortium members, keeping NHS funds within the NHS. NEP is exploring options to make it easier for organisations to join without the capital investment.

‘At this time, if an organisation wishes to take advantage of our full solution and join NEP, we would need to purchase additional software licences, unless they already had access to a licence in their own right,’ she says.

Almost three-quarters of the survey respondents said non-delivery of expected savings was a major risk in moving to shared services. There is a degree of scepticism over the savings produced by shared services, but Mr Beevers says the NHS SBS record speaks for itself.

‘Part of our five-year strategy is to produce £1bn in savings for the NHS by 2020,' he says. 'We have currently delivered circa £400m. For us to deliver the 2020 challenge, it will have to be across all areas. It’s a significant challenge and we are investing in our organisation and our services to achieve that.’

The NHS provider sector has been inching towards shared services for years, but with the financial environment and the weight of NHS Improvement behind it, 2016 could prove to be a turning point.

Shared landscape

The HFMA survey in September received 33 responses, three-quarters of which came from acute or integrated acute/ community trusts. Some were unable to give details of plans for financial services, as the direction of travel had not yet been decided. All had income planning, management accounts and commercial teams in house. The other services listed for review by NHS Improvement were shared to varying degrees:

• Financial accounts – the vast majority have this in-house (85%). One trust shared with other NHS providers, while four outsourced to a non-NHS provider

• Accounts payable – five shared with an NHS provider, six with a non-NHS service and 22 (66%) provided it in-house

• Accounts receivable – 72% of trusts provided this in-house; fie (16%) shared within the NHS and four (12%) with a non-NHS provider • Internal audit – was most likely to be shared with only one provider having the service in-house; 30% was shared within the NHS, while 67% had outsourced the work

• Payroll – almost half of the respondents have an in-house provider, while 36% share with other NHS bodies and 15% have outsourced payroll.

Unsurprisingly, the biggest changes are envisaged in the more transactional services. About 40% of trusts plan to move to shared services with other NHS providers in accounts payable and receivable, while one trust (3%) intends to outsource the services to a non-NHS provider.

The next biggest change is in payroll, with 27% intending to move to shared NHS provision and 6% (two trusts) outsourcing to a non-NHS provider. With most internal audit services provided outside the organisation, most trusts envisaged no change, though the one trust that has an in-house provider is planning to move to a shared NHS provider.

While most arrangements for financial accounts will stay the same, six trusts (19%) will move to share with other NHS bodies. There is also little movement in commercial teams and income planning, with three trusts (9%) looking to NHS shared arrangements in both categories. Most (94%) see no change in management accounts provision, though two trusts plan to share with other NHS bodies.

While some see changes taking place by the end of the financial year, most anticipate that changes will happen by April 2018.

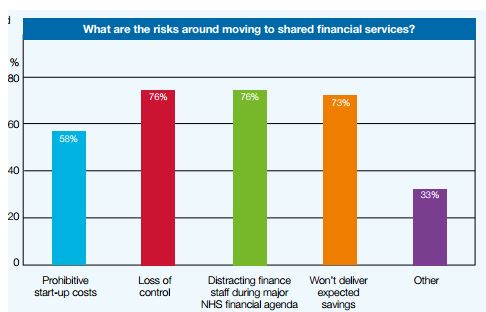

The potential to distract finance staff and a loss of control were seen as the greatest risks of a move to shared financial services, closely followed by the risk of expected savings not being delivered. Some 58% voiced concerns over prohibitive start-up costs.

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.