News / A bumpy ride

With each new financial year the prognosis for the NHS in England is increasingly dire and 2017/18 is no different. It’s not hard to see why. Waiting list and the four-hour A&E targets – the two great weathervanes for the service – have largely been missed. But is it time for doom and gloom or should the NHS be cautiously optimistic? Has 2016/17 been about steadying the ship, before turning it around?

Even before the refreshed Five-year forward view, it is looking as though the service will hit overall financial balance in 2016/17 – helped by a £1.8bn sustainability and transformation fund and an £800m commissioners’ risk reserve.

The reserve will offset a provider deficit that at quarter three was forecast to reach £873m. HFMA policy director Paul Briddock said viewing the provider position as poor because they are still in deficit is too one dimensional. Compared with 2015/16, he said the deterioration in providers’ financial position has slowed and potentially stopped.

‘It’s quite a remarkable achievement, especially as providers pulled out efficiencies of 3.3% by the end of the third quarter and believe they will get to nearly 4% by year-end,’ Mr Briddock said. ‘We have to remember they are facing a 3.5% rise in A&E attendances and a 28% increase in delayed transfers of care due to issues with social care funding. They are more or less absorbing these pressures and taking a huge cut out of agency spending, though obviously waiting times have suffered. However, that doesn’t mean that I think next year is going to be any easier.’

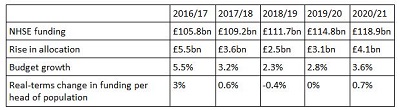

Following a frontloaded spending review settlement, funding growth over the next few years will fall before recovering to some extent in the final two years (see table). ‘The NHS has done well in 2016/17, but the reality check is that the years between 2017/18 and 2020/21 are going to be tough,’ said Mr Briddock.

NHS Providers said trusts had an average CIP of 4% in 2016/17. However, 30% of trusts have not agreed their control total for 2017/18 – this group of trusts were asked to deliver an average CIP of 6.4%. In some trusts, the CIP is 9% or more (see box).

According to NHS Providers, trusts will need to absorb a 5.2% demand and cost increase, together with delivering key waiting time targets and eliminate the aggregate deficit. New commitments on cancer and mental health could cost £150m to £200m. While funding will

increase by 2.6%, NHS Providers said this is not enough to cover rises in demand and costs. A further £2.4bn to £3.1bn would be needed to ensure performance targets were met.

NHS Providers chief executive Chris Hopson said this added up to ‘mission impossible’ for trusts. ‘The standards on A&E and surgery were set for a good reason – they are a good proxy for the quality and access to care the NHS should provide. But trusts can only deliver if funding keeps pace with rapidly rising demand,’ he said.

‘Trusts won’t be able to recover the A&E and elective surgery targets across the whole year. Just stabilising the rapidly increasing performance decline would be an achievement in itself. Given that demand and cost increases will easily outstrip funding and efficiency increases, just reproducing this year’s financial performance is a stretching target.’

He called for greater flexibility, with trusts given more realistic performance trajectories and more support to eliminate unwarranted variation. Money could be directed from central budgets to the front line.

Mr Briddock argues that the case can be made for additional funding, with the UK spending less on health as a proportion of GDP than the likes of France and Germany. ‘If there is no more money for health, that will mean more co-payment or the NHS scaling back on the levels of service provided. That’s happening already with waiting times.’

Waiting times targets have not been hit for the best part of two years and health secretary Jeremy Hunt has insisted they will be met in 2017/18. Mr Briddock accepts that additional social care funding may reduce delayed discharges, but he does not think this will have a major impact on existing capacity shortages.

The King’s Fund said financial pressures are not just affecting waiting times. Its report, Understanding NHS financial pressures, said community and public health services were often the hardest hit by the slow down in funding since 2010/11. It found evidence of cuts in sexually transmitted infection and district nursing services, adding there was emerging evidence that elective hip replacement was beginning to be affected.

British Medical Association council chair Mark Porter claimed care was increasingly being rationed. ‘Waiting lists should not be rising, and yet they are,’ he said. ‘Decisions on patient care should be based on individual clinical need and follow royal college or other evidence-based standards. Doctors always want to deliver the best care for patients, but we can’t continuously plug gaps by penny pinching and poaching from elsewhere in an overstretched NHS.’

Hopes to address these issues lie with the 44 sustainability and transformation plans (STPs). However making progress is extremely challenging ‘People are fire fighting and working hard on balancing their year-end position. It’s difficult to find the headroom to work on the transformation agenda – changing service delivery models or increasing self management of care, for example,’ Mr Briddock said. However he added that, while there were concerns over governance, the association’s last Financial temperature check highlighted improving relationships across health economies.

It’s not a revelation to say 2017/18 will be tougher than 2016/17. The service has done a good job in largely stabilising its finances, but in 2017/18 it will once again be asked to deliver – on finance, transformation, safety and, as ministers have made clear, slippage in waiting times will not be tolerated.

NHS Providers survey findings

Trusts will be required to deliver a step change in cost improvements in 2017/18, according to NHS Providers. It found that 70% of 99 surveyed providers had agreed control totals forthe new financial year. On average, their cost improvement requirement was 4.2% - up slightly on the 2016/17 average.

However, the 30% that had not agreed control totals – and so not able to access sustainability and transformation funds – had an average CIP of 6.4%. Some 5% of trusts were asked to make savings in excess of 9%.

The survey highlighted trusts’ reliance on one-off measures, including capital to revenue transfers, to make up the shortfall in recurrent savings. Two-thirds of respondents said they had relied on such measures, though fewer expected they would depend on one-off savings in 2017/18.

NHS Providers finance policy adviser Edward Cornick said: ‘We can see the scale of the task facing providers next year equals not a gradual change but a dramatic one. The fact that NHS Improvement concluded 30% of providers need to make a 6.4% cost improvement clearly shows that the service is in for a very bumpy year financially. Under such circumstances it is hardly surprising, from a governance perspective, that these providers felt unable to agree to control totals.

‘We are entering a year when providers are being asked to make savings that are simply of a different magnitude than at any other time,’ said Mr Cornick.

Related content

The Institute’s annual costing conference provides the NHS with the latest developments and guidance in NHS costing.

The value masterclass shares examples of organisations and systems that have pursued a value-driven approach and the results they have achieved.